Verus Sound Thinking – 2023: The Return of Simplicity (Download the PDF)

Each January we consider the year just gone and the year ahead. We assess the suggestions that we made the previous year to see what we called correctly and where we got things wrong. We also suggest topics that we believe should be on the agenda for the balance of the coming year. So what are the topics we think matter for 2023?

- Inflation: Down, bumpily

- A landing: But what kind?

- Rates: Lower but slower

- Zero makes heroes: Funded foolishness failing

- More office pain: The slow recognition of reality

- International markets of mystery: Or opportunity?

- Active opportunities: Decision making matters

- Private pain: A drag for a while

- ESG: Louder not quieter

- Simple beats complex: With a twist

We will delve into each of these later in the piece. But first, we look back at 2022 and assess how our predictions performed.

2022: A difficult year

2022 was a very unusual year, with a combination of geopolitical, economic, and market events that made for a very challenging investing environment. So how did we do with our past year’s recommendations?

1. Supply chains: Normalizing, not normalized

We predicted that many of the supply chain disruptions caused by Covid-19 would reduce or vanish, and shipping rates for freight would return to something like normal. We have seen exactly that happen; for example, by looking at the Freightos Global Index, which indicates a price drop of -75.8% during 2022. We also expected to see fattening of the onshore element of the supply chain – this trend continues. We can count this prediction, then, as a success.

2. Inflation: Lower, not lowest

We predicted that inflation would be lower landing at or above the mid 3% level, much lower than the outcome. We thought supply chain improvements would help lower inflation (as supply chain problems had helped ignite it), and believed the year-on-year effect would help. We were correct on these features – and we were also correct that shelter costs and changes in labor-market patterns would be drivers of higher inflation for longer. Despite this, though, this forecast does not count as a success – we identified the drivers of inflation but not the relative magnitude. Inflation is, and remains, much higher than we had expected.

3. Rates: Higher, but not high

We expected short-term interest rates to rise, but thought these rises would be gentle. We did warn of a meaningful chance of larger rises if central banks believed the economy had changed significantly and suggested investors plan for that possibility. We can count this as a half success – our base case was over-optimistic, as we thought inflation would be more controlled, but we correctly warned investors about the possibility of much larger interest-rate hikes.

4. Risk assets: Moderately positive

We thought returns from risk assets would be mildly positive because we expected a benevolent economic environment. We warned that there were likely to be periods of pain for risk assets, and at least the normal number of 5% downdrafts. In reality, risk assets had a difficult year due to interest rates and inflation, with the S&P 500 notching twelve drawdowns of 5%. We can claim some success from the warnings of downside risk, but this should be scored as a miss.

5. Private markets: Challenges

We warned that the superb private-market outcomes from 2021 were likely a one-off and reiterated that private-asset programs should be assessed on a very long-term basis. We warned investors to expect more typical returns from their private-market portfolios in the future, and also identified some of the asset-allocation challenges from the denominator effect. This was a good description of the world of private markets in 2022, with private markets posing medium-term return, liquidity, and portfolio-structure challenges. We can mark this as a success.

6. Politics: Agree to disagree

We correctly suggested we would see a contentious political landscape and that by year-end we were likely to see a divided government. We also correctly predicted that markets were unlikely to be concerned by these events.

7. China: And geopolitics

We discounted the prospect of China invading Taiwan, while identifying the possibility of some form of Russian saber-rattling (although we did not expect a full-scale invasion of Ukraine). We suggested investors should think about the challenges China poses to emerging-market portfolios, with outsized influence due to size, and questions of geopolitics and ethics becoming more important as these come into focus. This was sound advice – the effect of China on emerging markets was very evident during the year.

8. Data: Broken by Covid-19

We continued to flag much greater uncertainty in data (more than usual) caused by the effect of Covid-19 and warned that investors needed to be careful drawing conclusions without careful analysis of how the data has been distorted. This was correct – a good example is the labor market, where it remains unclear how much labor market tightness relates to retirements, illness, Long Covid, economic decisions, or simple data errors.

9. Real estate

We continued to warn about the challenges embedded in real estate, while recognizing that opportunities were likely to arise. We were correct in this, flagging the long-term nature of the pricing process in office space, for example, and calling out the fact that there was likely significant pain to come.

10. ESG: Adding the “you”

We correctly identified the challenges that were likely to come to the one-size-fits-all approach to ESG implementation and suggested that investors would (and should) begin to look for more tailored solutions reflecting their own views, beliefs, and regulatory focuses. ESG is now clearly seen by many as a political issue, with different states taking different approaches and investors and managers having to think carefully about the approach they take in each marketplace.

This brings our score for last year to seven out of ten correct – a fairly good score in a challenging year. Our biggest mistake was underestimating the extent of the inflationary environment both in scale and in length. While we correctly identified the factors involved, we failed to identify the extent of the impact and how long it would take for inflation to peak. We were not alone in this call, as few forecasters – even those predicting higher inflation – predicted quite how high it would get before it peaked. Other than this, however, we were fairly successful.

And with that we move to what we expect for the balance of 2023.

2023: The return of simplicity

The changes we have seen in market prices, interest rates, and economic conditions over the course of 2022 have left us in the early stages with quite a different environment. That environment is one where we believe simple solutions will be able to perform effectively, and that change will allow investors to reassess their portfolio structures, making them simpler, clearer, and potentially more efficient and effective.

We have ten topics for discussion – we have tied these to things investors should do, and where possible, to metrics to assess the success of our predictions.

- Inflation: Down, bumpily

- A landing: But what kind?

- Rates: Lower but slower

- Zero makes heroes: Funded foolishness failing

- More office pain: The slow recognition of reality

- International markets of mystery: Or opportunity?

- Active opportunities: Decision making matters

- Private pain: A drag for a while

- ESG: Louder not quieter

- Simple beats complex: With a twist

We begin with inflation.

Inflation: Down, bumpily

Despite the upside surprise last year, we still believe inflation will drop.

There were two important drivers of the inflationary surprise last year.

- The first was economic disruption – particularly to the supply chain – caused mainly by Covid-19. This created a series of inflationary surprises in specific areas of the economy, like used cars. Aftershocks from it continue today and are currently affecting the labor market.

- The second was highly expansionary economic policy and lax monetary conditions –extraordinarily low interest rates combined with highly supportive fiscal policy. Loose money was a feature of the previous ten years without causing strong inflation, but in this case the combination of the vast scale of monetary looseness and the existing inflationary pressure was enough to spark the high inflation we experienced.

These two drivers clarify the likely path for the year.

Central banks have moved decisively on the interest-rate side of the equation, and a series of measures of credit availability and money supply show that the monetary side of the ledger is now much tighter than this time last year.

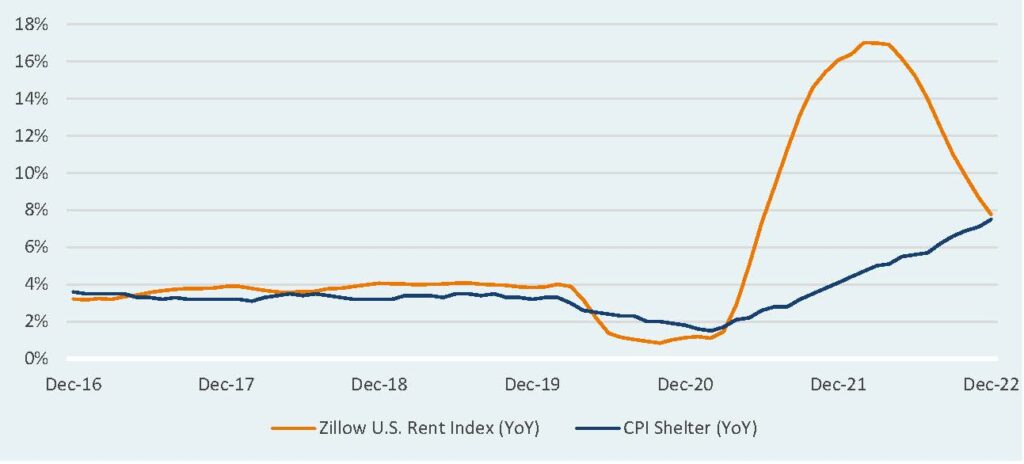

We can expect this tightening pressure to dampen inflation as it slows the economy. The other side of the ledger also points a path towards lower inflation – many aspects of the inflation statistics are already showing rapidly dropping inflation, with some even suggesting deflationary pressure – though some parts of the economy take time to react. A good example is the Shelter portion of the inflation calculation – slow moving, and a strong push factor on inflation during the last year, but leading indicators like the Zillow U.S. Observed Rent Index suggest prices are likely to come under pressure during the remainder of 2023.

In combination, this suggests a path to lower inflation, bringing it down to around the level we expected last year. That, therefore, is our measure of success for this prediction: inflation at or below the mid 3% level by year end.

We see two possible road bumps. First, as China reopens, the chance of more pressure on supply chains increases – that could provide a short-term boost to inflation, making moderation take longer. Second, with slow-moving data and a confused picture, it remains possible that the Fed will misjudge the path and that the economy will move from slowing inflation and into disinflationary territory for a while. Undershooting inflation could then lead to a whipsaw period with the Fed challenged for some time to find policy that fits economic realities. This undershooting possibility is our biggest concern, and we believe it is the most likely path if our expectations are not achieved.

A landing: But what kind?

Pilots often say that any landing you can walk away from is a good landing: central bankers take a different approach and prefer landings to be soft. Sadly, controlling an economic slowdown is a very challenging task; records of successful soft landings following an overheated economy are few. It is made harder today by the very strange post-Covid economy we are working in: data is unclear, tools are behaving in ways we do not expect, and people are acting quite differently than before. The path from a zero-interest rate environment to one where money has a price, and the capital market structure has rationality, is likely to be a difficult one (we talk about this below). Investors should consider using risk and scenario-analysis tools to understand how this potentially rocky scenario might affect their portfolio during the year ahead, although well-constructed portfolios are likely to be able to weather this rockiness as part of the normal ebb and flow of markets. We believe that concerns around stubborn inflation are legitimate, and it would be surprising to see inflation materially below the mid 3% range by year-end.

We therefore believe at least a mild recession of some kind this year seems likely, and a deeper recession is quite possible. We will count this prediction as a success if we see the economy narrowly avoiding recession or having only a very mild recession – but would not be surprised if that recession becomes deeper than most expect today.

Interest rates: Lower but slower

The previous two expectations tie to this third. Although we do not think we are quite yet at peak interest rates, we expect the rate cycle to ease a little in 2023 – but we expect the Fed to ease more slowly than the market would like. While the Fed wants to ensure a soft landing, they are alive to the dangers of going too easy too early. Their reputation would be more damaged by a resurgence of inflation than by a recession that is slightly more severe than expected (after all, the latter is just the result of normal, sound, monetary policy), and they want to establish inflation-fighting bona fides with the market. While the chance of a drop of some kind in rates by the end of the year is fairly high (interest rates have almost always been cut by the Fed when recession occurs), those cuts will likely be later and smaller than the market wants. Investors should be aware of this possibility, and while duration appears to be back as a hedging tool now that rates are higher, they should be aware that rate cuts are likely to be milder than has been the case in the past.

We will count this as a success if we see some form of policy rate decrease by the end of the year, but likely less than the magnitude of easing many investors would prefer.

Zero makes heroes: Funded foolishness failing

It is easy to appear smart when money is free. Once the environment gets more difficult and money has a price, it becomes clear who was actually adding value and who was not. That will particularly be the case in this cycle – rates have been so low, and the economy so supported, that there has been plenty of opportunity for foolishness to be funded.

More stories of these foolish business activities will appear. The crypto space, although unlikely to vanish, could see further revelatory news events. A number of glamorous market favorites from the last few years will likely appear much less attractive. But this extends beyond just the new and glamorous: a series of old, established companies whose day is past but who have survived on a diet of cheap money and generous terms will disappear over the year as the capital market realities come home to roost. The common factor is zombie capital – where the money has been invested, the loss has happened (effectively if not actually), but recognition of the loss has yet to sink in. Investors should spend time this year looking through their portfolio and asking difficult questions about the robustness of the investment case for each exposure – particularly those that are new and/or “interesting”.

It is difficult to identify a particular measure of success for this. If we had to pick a metric, it might be a number of major stories in both new and old economies where large-scale or fashionable enterprises disappear during the year due to lack of funding. Additionally, this may become visible in rising credit default rates (although this may be masked by corporate acquisition activity, allowing the companies concerned to disappear without technical default events).

More office pain: The slow recognition of reality

One area where there appears to be a particular gap between reported and actual pricing is the real estate space, and specifically the office segment of the real estate market. Working patterns have changed since Covid-19, and the nature of demand for office space is very different than it was five years ago. Nobody knows what the new working environment will look like exactly, but there is little argument that most office-based companies seem to have concluded that most employees can work remotely at least one or two days each week. That represents a 20% to 40% reduction in days in the office, and there is no doubt this changes the demand for floorspace and facilities. It also changes the nature of in-the-office time, and the amenities demanded by workers – and the type and size of demand for the support infrastructure represented by the shops, bars, and restaurants in the central business districts of cities around the world.

Very little of this is clear – and with long leasing cycles and few real estate transactions, we are only in the early stages of market adjustment to reflect these changes (although it is worth noting that REITS have discounted at least some of the potential pain relative to private market vehicles). Worse, the impact of these changes is likely to be focused on “safe” funds, which had historically derived that safety from investing in “high quality” buildings in “high quality” marketplaces. The post-Covid world has changed what “high quality” means in this context, and prices will adjust to reflect that change. Many core real estate funds now have long exit queues, and it seem unlikely this will change soon. There remains opportunity in real estate over the long term, but that opportunity will be in other parts of the marketplace and may take time to materialize. Investors should consider where that opportunity will sit and prepare to allocate to it when it becomes available.

This expectation will be shown to be correct if exit queues from large core funds remain large through the year, and if prices continue to correct lower.

International markets of mystery: Or opportunity?

U.S. equities have been the market leader, yielding a 12.6% annualized return over the past 10 years, compared to 4.7% and 1.4% for international developed and emerging market equities, respectively. Those returns have come from both the faster growth of the market itself and from the effect of currency – dollar strength providing relative benefits to U.S. investors who keep their assets domestically. This has benefited the typical U.S. investor, who has generally had a strong domestic bias in their asset allocation.

At the same time, many in the investment industry have been aware of the relative valuation of international assets, which on a relative basis have appeared extremely attractive for large parts of the period. Looking at our Capital Market Assumptions, we can see this is the case, for both international developed and emerging markets. That valuation case has often been strengthened by investors assuming that these markets and economies were “just like here” – thinking about the development of the EU as if it were the early period of U.S. independence, for example, and consistently looking for the “Philadelphia Moment” in each monetary, economic, or political crisis in the EU. Although Verus has been careful not to fall into this “they’re just like us” trap, we have recognized the valuation and investment story as a strong one and have been serially disappointed by the poor performance of many of these markets.

However, we believe this year the tables may turn. Both developed and emerging markets are exceptionally cheap, and the worst-case scenarios that seem to be priced into those markets seem unlikely to materialize. Some inflation is back in Japan, and some of the changes to corporate governance and shareholder rights that have been happening there over the last 10 years may be bearing fruit. Europe continues to have problems, but in the short term appears to be performing better economically than the most-pessimistic expectations. While the war in Ukraine continues, the global economy is adapting to it fairly well. And so on. It also seems likely the headwind that investors have experienced from dollar strength may be reduced – indeed the dollar may even have a period of relative weakness. We believe investors should be comfortable having exposure to these international market opportunities – maybe more than usually so.

Success of this forecast will be assessed by simple market performance (in dollar terms) of international and emerging equity markets. We expect these markets to do no worse than the U.S. market and believe there is a good chance they will perform better during the balance of 2023.

Active opportunities: Decision making matters

The case for passive management is well understood – but the requirements for successful active management are less so. The broad case for passive (that in aggregate, all investors must produce the return of the market, less costs) is inarguable. More, a market where there is little surprise, where news flow is predictable, and where there is little difference between expectations and reality is one where even individual active managers are likely to have little chance to add value. However, a market where there is plenty of unexpected news, plenty of disagreement about the prospects of individual companies, economic uncertainty, and a wide range of stock price performance, is one where individual active managers with skill can do well.

We believe the environment today is a high-disparity one, and therefore individual active managers have the opportunity to produce greater alpha than normal. With a wider range of possible outcomes, managers with real skill should be able to generate material outperformance relative to the market and their peers. Of course, the corollary is managers who lack skill are likely to underperform materially – but this simply means the time and attention investors put into manager research and selection should be rewarded.

Investors should strongly consider spending more time than usual in this space during the year, ensuring the managers in their portfolios are well set up to capitalize on this opportunity. Not all legacy managers will be able to manage this new world, which suggests a focus on active risk budgeting and tracking error allocation will be worthwhile.

Success in this area can be measured by looking at the disparity between first- and fourth-quartile managers across a range of asset classes: it should be broader than usual during 2023, and the managers with demonstrated skill should be able to add real value.

Private pain: A drag for a while

The new environment is likely to pose problems for some private-market portfolios. More expensive money means the owners of capital have less of a need to reach for return. At the same time, this makes some of the private-market leverage tools which have helped generate returns in the past more difficult and expensive. Private-market participants will find that exits may be harder, fundraising more challenging, the economy less opportunity-rich, and investors less forgiving. Investors are likely to learn that “volatility smoothing” which is part of the private-market structure does not mean the same thing as “downside elimination” – some of the bad news we saw from this space during 2022 is likely to continue. Private markets do not always move up and to the right.

Adding to the challenges investors are facing will be the fact that many have allocated more than is comfortable to illiquid markets. This means the liquid parts of their portfolios are coming under pressure as a source of funds and as a tool for rebalancing. A material part of the investor community should consider what their true liquidity risk tolerance is, and whether they now find themselves on the wrong side of it.

None of this means investors should take their eye off the fact that private-market investments should be considered over the long term, nor that private markets are a real opportunity to produce return. However, it does mean investors could reasonably revalidate their long-term approaches to private and illiquid allocations, and in particular perform liquidity sensitivity analysis, to make sure they remain comfortable with where they are planning to go, as well as the implications.

Our specific forecast here will be a success if the private elements of portfolios continue to produce below-average returns during 2023.

ESG: Louder not quieter

Over the last few years, we have watched the ESG conversation grow in the industry. It has become increasingly clear there is no consensus within the United States on many Environmental, Social, and Governance issues. It is also clear the regulatory environment varies significantly across the country, and by type of investor – and the regulatory environment itself is changing rapidly to make sure the views, goals, and standards of the stakeholders of capital are appropriately represented.

This trend is likely to continue and even accelerate during 2023. We expect more direct legislative, regulatory, and investment action both in favor of and against ESG investment approaches. We also expect a wider range of views and topics to be brought into this conversation, turning ESG more into a discussion and less into a movement.

We believe investors should be aware of the issues involved and how it impacts them. The right approach for each board of fiduciaries to take depends on their goals, stakeholders, and regulatory structure: each board and each fiduciary should understand these issues and how they apply to them. A successful forecast here will be fairly clear. We expect continued discussion, disagreement, and coverage of this topic, which will remain highly controversial.

Simple beats complex: With a twist

Our final expectation brings us back to our investment philosophy and the move by markets to a more normal world: with cash generating a positive return, a more normal capital market structure, and Capital Market Assumptions that give investors the prospect of at least coming close to achieving their goals with traditional asset classes. Despite the pain we have suffered to get here, this environment is a net positive for investors. Fewer heroic risks should be required to achieve desired investment outcomes. We believe a simple 60/40 portfolio is likely to perform relatively well this year, although investors should think more globally, at least on the equity side, and make sure that the equity allocation is globally diversified, not simply U.S. focused.

This all suggests that now may be a good time to go back to basics in portfolio construction: identify sources of complexity and illiquidity that are no longer needed and eliminate them where prudent and possible. While markets are not fully back to normal, and while there remain good reasons for many investors to continue to hold some illiquid and complex exposures, a focus on simplicity and clarity is likely to pay off in the long term.

Success in this forecast will be achieved if a global 60/40 portfolio performs better in 2023 than it has on average over the last 30 years.

Conclusion

In some previous years the topics we have focused on were fairly disparate. In 2023, the topics that we feel are important are interrelated. We believe we have moved into quite a different world relative to the one of the recent past, and this new world will present both challenges and opportunities. Focusing on these 10 things should help investors navigate this new (yet familiar) market and economic environment: a move back to simpler and clearer ways to deliver outcomes is likely to come with a healthy return on investment.

Disclaimer

Past performance is no guarantee of future results. This article and the related podcast (if provided) is for informational purposes only and is directed to Verus’ institutional clients. Nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security or pursue a particular investment vehicle or any trading strategy. The opinions and information expressed are current as of the date provided or cited. This information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability.