Markets are keenly monitoring inflation, being a major catalyst behind global central bank policy decisions. Sticky inflation and better-than-forecasted growth in the U.S. has set back rate cut expectations, likely resulting in policy divergence relative to the Bank of England (BOE) and the European Central Bank (ECB).

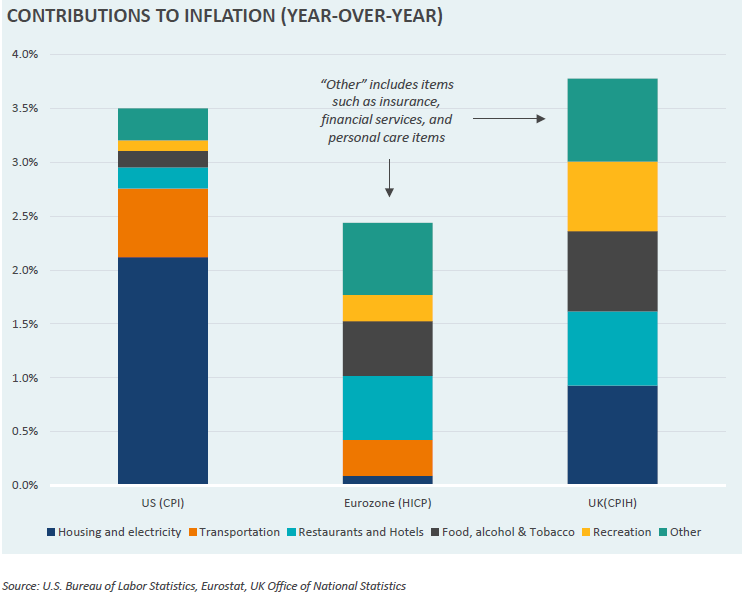

GDP readings show stagnant economic growth throughout the Eurozone, while the U.K. experienced a technical recession in 2023. Falling price pressures combined with lackluster growth has given these central banks greater incentive to cut rates, particularly the ECB. Futures markets are pricing in rate cuts to start this summer, whereas U.S. interest rate cuts are not priced in until November. Our market note focuses on contributions to inflation across the U.S., U.K., and Eurozone, helping the reader better visualize major price pressures experienced across each region.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.