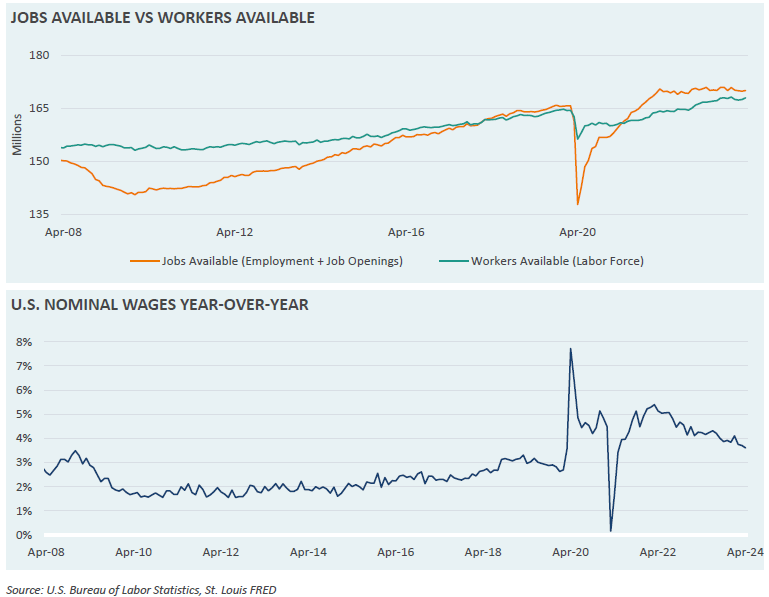

Following the pandemic and initial recovery, the U.S. economy found itself amidst a uniquely tight labor market – meaning there were more jobs available than workers to fill them. This dynamic pressured employers to increase wages, raising the cost for a key input of all goods and services.

Over the last two years, the labor market has loosened, with the gap between available workers and jobs closing. At the same time, wage growth has slowed to its lowest level since before the pandemic. These labor market metrics will be important to monitor as the Federal Reserve has continued to reiterate that it needs inflation to move “sustainably towards 2%” before cutting rates. Following the drop off in jobs added in April, further weakness in the labor market might encourage the Fed to deter prolonged economic stagnation by cutting rates.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.