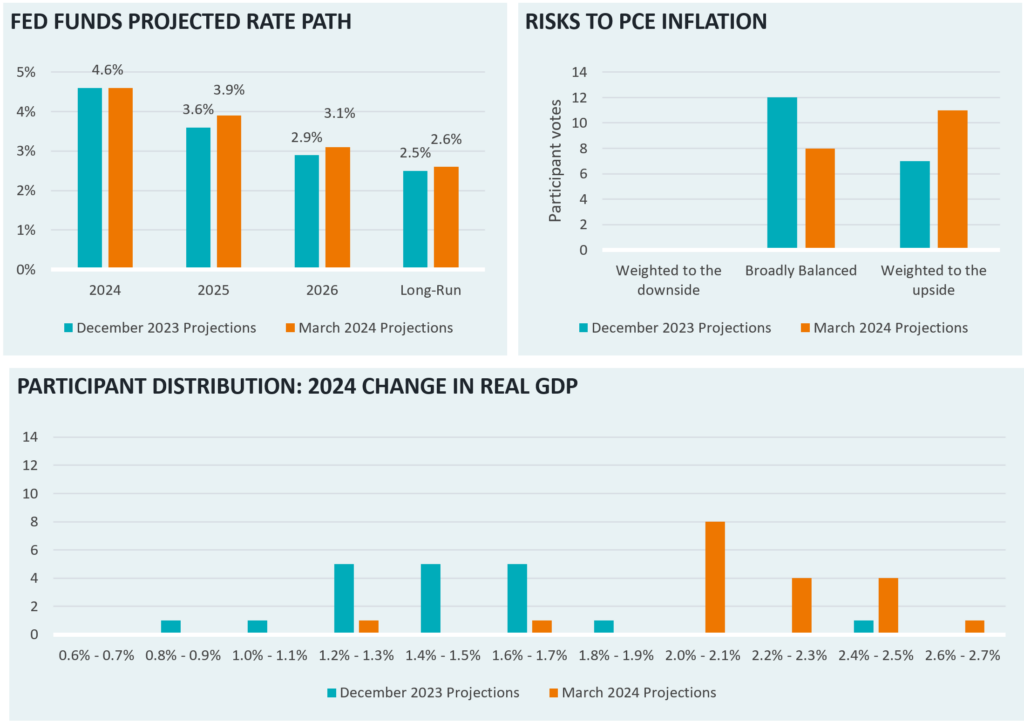

The March FOMC meeting went largely in line with expectations. The Federal Reserve made no changes to their main policy rate, while their quarterly Summary of Economic Projections were little modified from last quarter. The Federal Reserve communicated that they still expect to cut rates three times by the end of 2024, which provided a significant boost to risk assets, propelling the S&P 500 to close +0.9% higher–notching a new all-time high.

While markets ended on an optimistic tone, the Federal Reserve continues to face a difficult balancing act. FOMC participants now see greater upside to risk to PCE inflation compared to their December projection, in line with rising inflation concerns sparked by the CPI print last week. At the same time, participant expectations for 2024 GDP growth has improved, which typically acts as a tailwind to price growth.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.