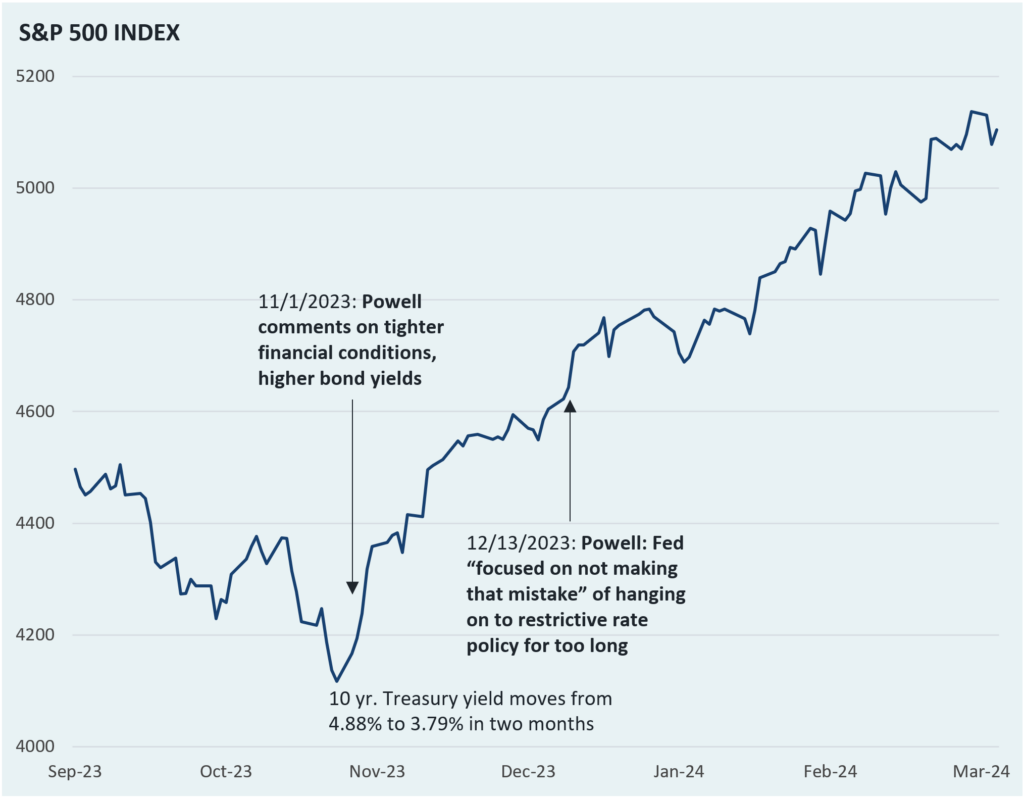

Certainty about the Fed’s thinking has been hard to come by in recent years, so it’s no surprise that equity markets rallied as the Fed signaled the end of its hiking cycle.

While a change in the Fed’s tone fueled this rally, it has been sustained by strong earnings, ample liquidity in financial markets, good economic data, and moderating inflation.

Moving forward, we think the Fed will be resolute in keeping the policy rate higher than markets expect. In the face of a strong equity market, tight credit spreads, and low unemployment, the Fed will likely continue to prioritize risk of re-inflation rather than risk of an economic slowdown. Markets may moderate as these expectations change, but given the recent rate pause and subsequent rally, an eventual cutting cycle could bring an even larger boost for equities.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.