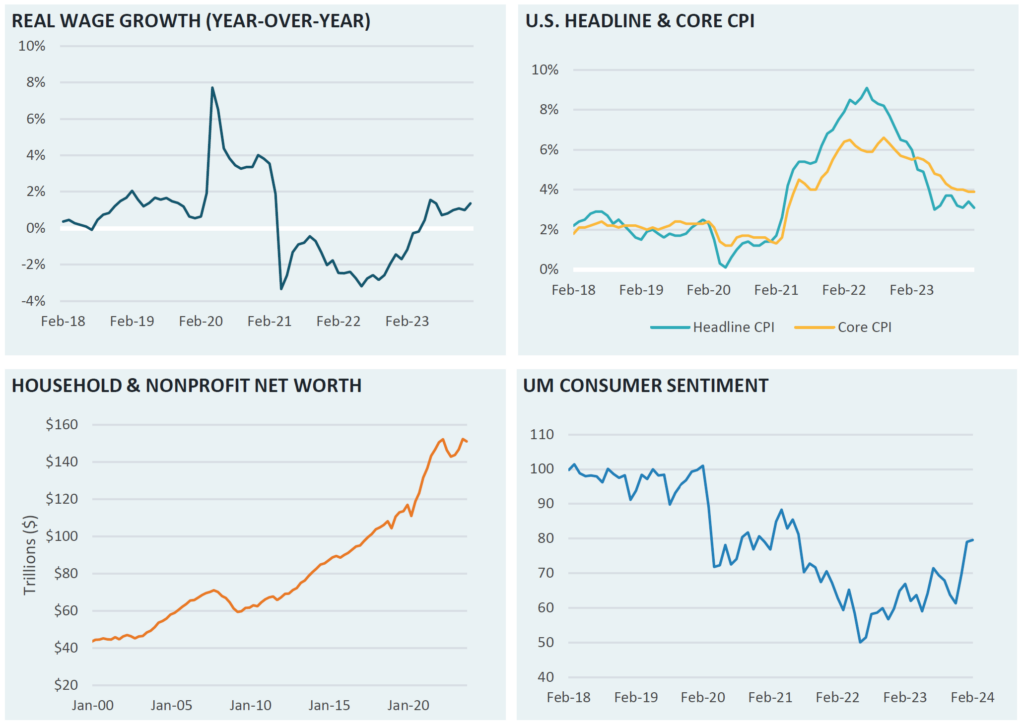

U.S. consumer sentiment has steadily recovered from very depressed levels in 2022, as households face slower inflation growth and real wage growth moving back to positive territory. These factors, combined with the underpinning of a massive wealth expansion over the past decade, have likely played a large role in the general boost to sentiment.

While positive from an economic perspective, better consumer sentiment contributes to a “good news is bad news” environment for the Federal Reserve, as hotter domestic spending increases the risk for inflation to remain elevated above target. As such, markets have recently priced in a longer delay before the first Federal Reserve rate cut. While bonds have seen losses recently, equity markets have been volatile with a murkier direction, especially as Q4 earnings figures arrive.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.