Markets closed out 2023 with impressive gains over the calendar year, going against consensus expectations amongst both economist and market strategists.

Slowing inflation combined with better-than-expected economic growth and labor conditions in the U.S. helped to notch a more than 20% gain from the S&P 500. Additionally, signaling of easing from the Federal Reserve in the fourth quarter provided a tailwind to broader global risk assets.

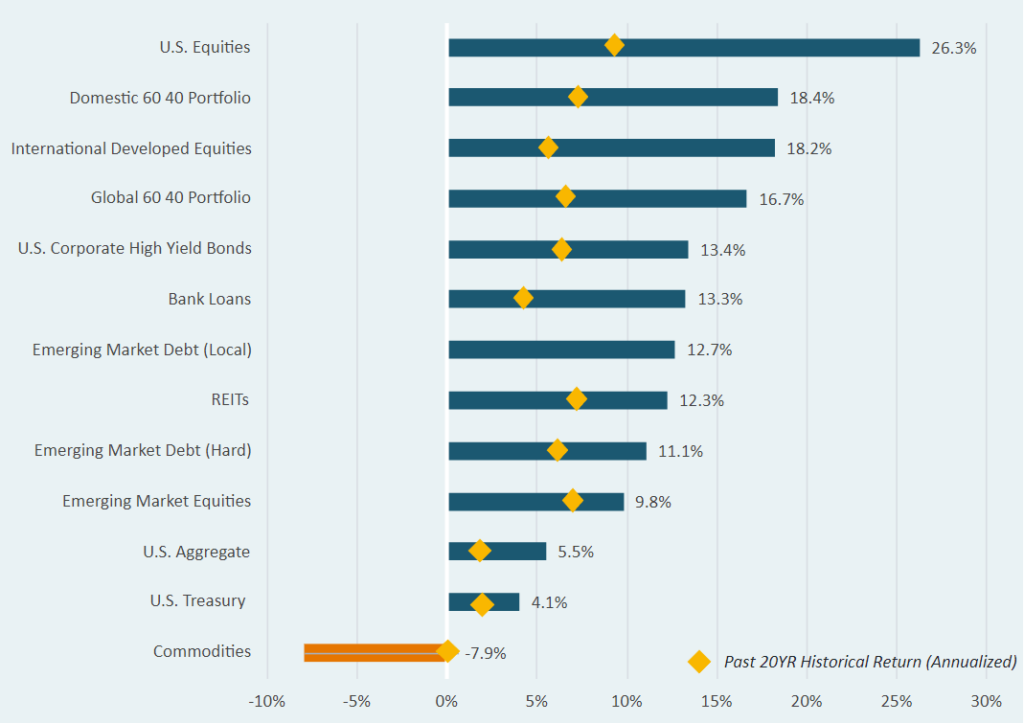

Most major asset classes saw gains over the year. Fundamentals held steady across global equities and credit in the face of coordinated monetary tightening due to inflationary forces seen across most developed countries. Commodities were the outlier, as the supply concerns that provided a tailwind to inflationary forces reversed course.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.