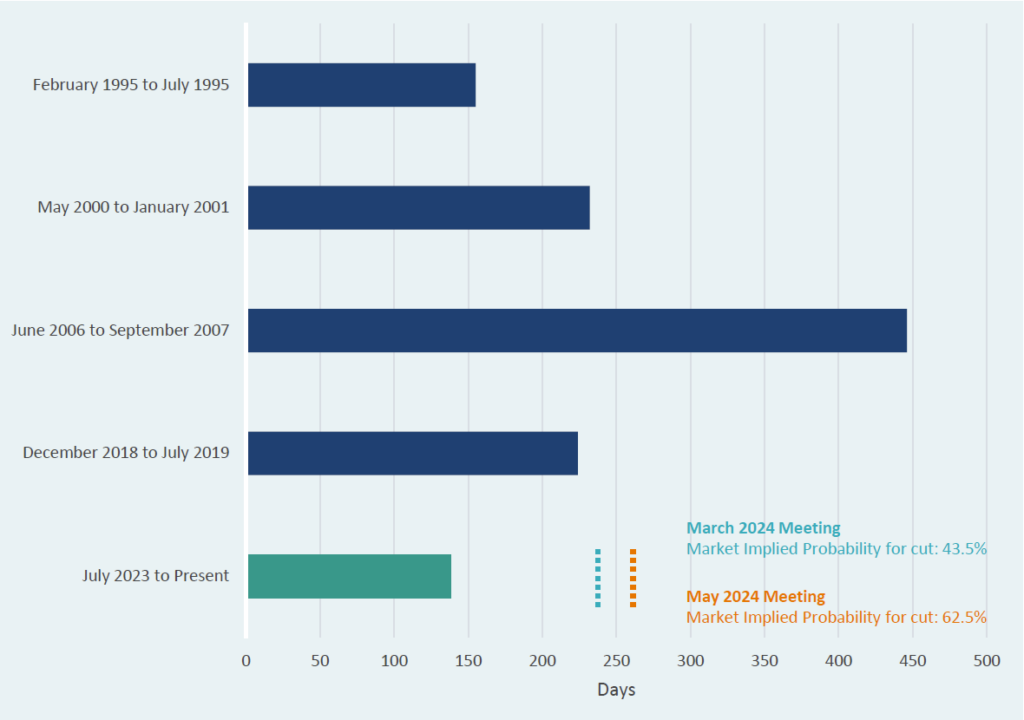

The Federal Reserve has held rates steady to achieve price stability. Growing speculation around rate cuts in 2024 align with the historical time between policy shifts relative to the most recent Fed tightening cycles.

Commentary will be the focus of the Fed’s last policy meeting of 2023 on Wednesday. Market participants will be focused on further clues around the Fed’s timeline to shift policy from tightening to easing.

The rationale behind the Fed cutting rates matters, as cuts due to expectations for contracting growth paints a worse environment for risk assets relative to the Fed cutting due to confidence in controlling inflation. This carries into the ongoing “higher for longer” vs. “soft landing” narratives.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.