Throughout 2023 and the first half of 2024, the U.S. equity market has had an incredible run. While earnings growth has been strong thus far with a growth rate of 5.9% year-over-year, most of the performance has come from increasing valuations. Loftier valuations have been primarily driven by mega-cap companies—many of which have been involved in artificial intelligence investment. These high valuations could arguably be justified by the prospect of future earnings growth, which can be a major component of total equity returns. This means that earnings season is even more important as valuations are arguably stretched.

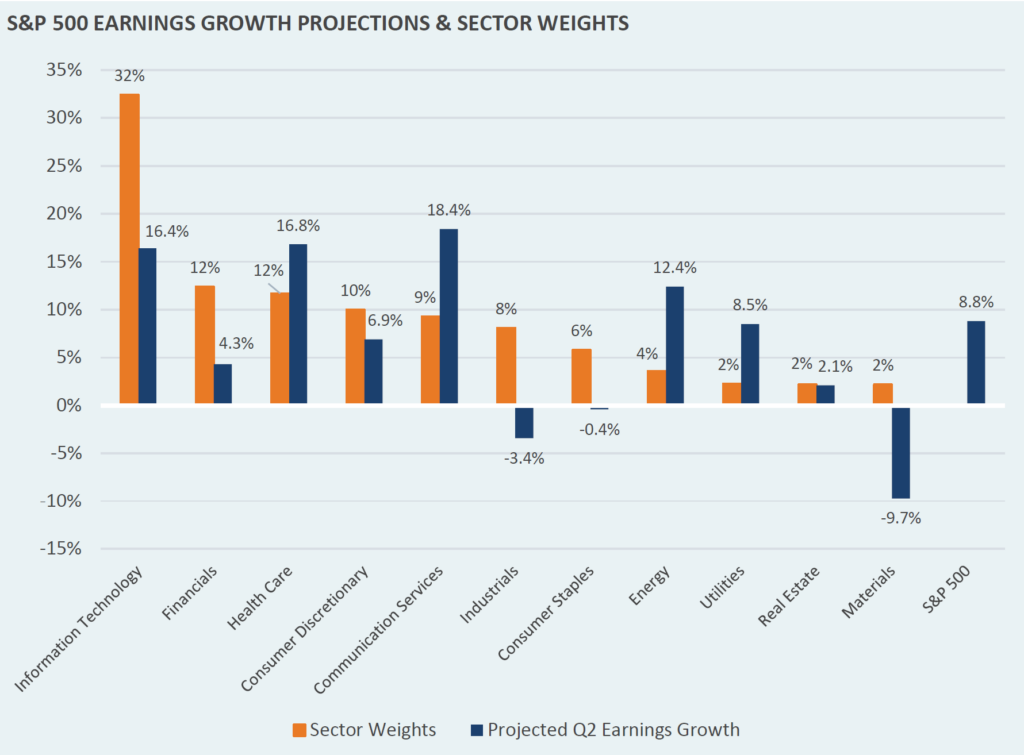

This week’s Market Note looks at projections for the upcoming Q2 earnings season. Technology and communications collectively make up over 40% of the S&P 500. If high valuations are going to be justified going forward, the high growth sectors must deliver strong earnings to keep up with the current market prices.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.