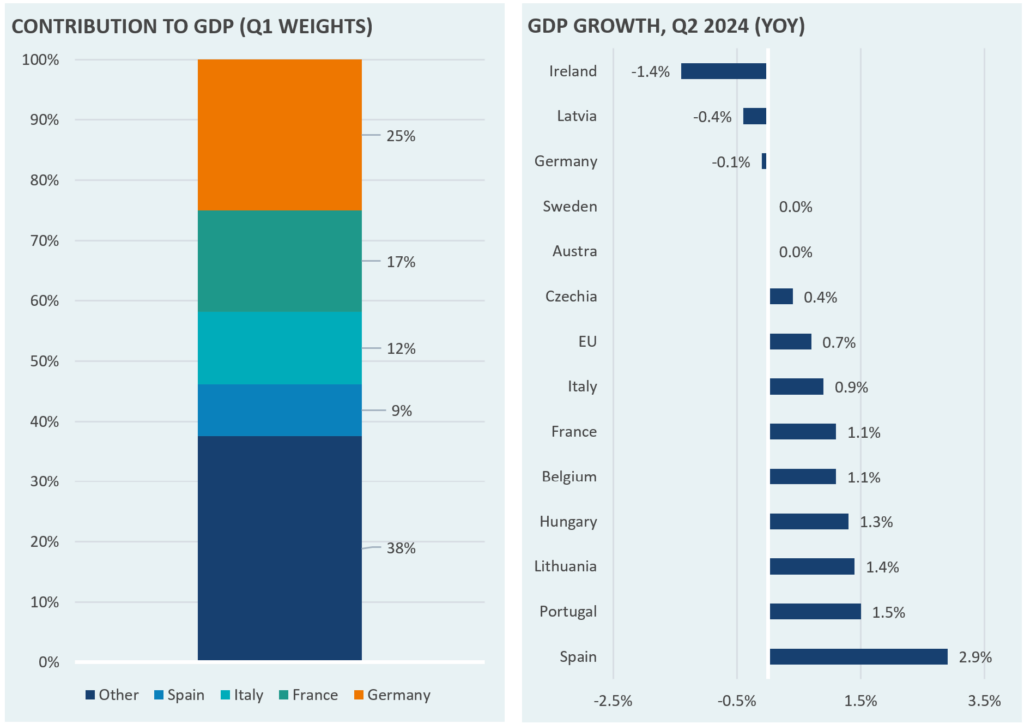

A prominent story in international markets following the pandemic recovery is the lackluster growth of European economies, in comparison to the U.S. market. This has been reflected in equity markets, with the S&P 500 returning 16.7% so far this year, compared to just 10.8% from the Euro Stoxx 50. A major contributor to this weaker growth is contraction from the EU’s largest economy, Germany. A decline in fixed investment is being pointed to as the primary reason for the shrinking economy in Q2. However, since the Russian invasion of Ukraine in 2022, Germany’s manufacturing sector has been especially dragged down by high energy prices and the higher rates introduced over the past couple of years.

This week’s Market Note looks at the contributors of economic growth in Europe as of Q2, on a year-over-year basis. While Germany saw contraction, growth for Europe’s three next-largest economies—France, Italy, and Spain—contributed the bulk of the growth that the EU experienced over the last year.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.