Japanese stocks sold off Friday and Monday overnight, after a 0.25% interest rate hike sparked fears of a long-term higher interest rate environment. The overnight selloffs sparked substantial volatility when markets opened on Monday.

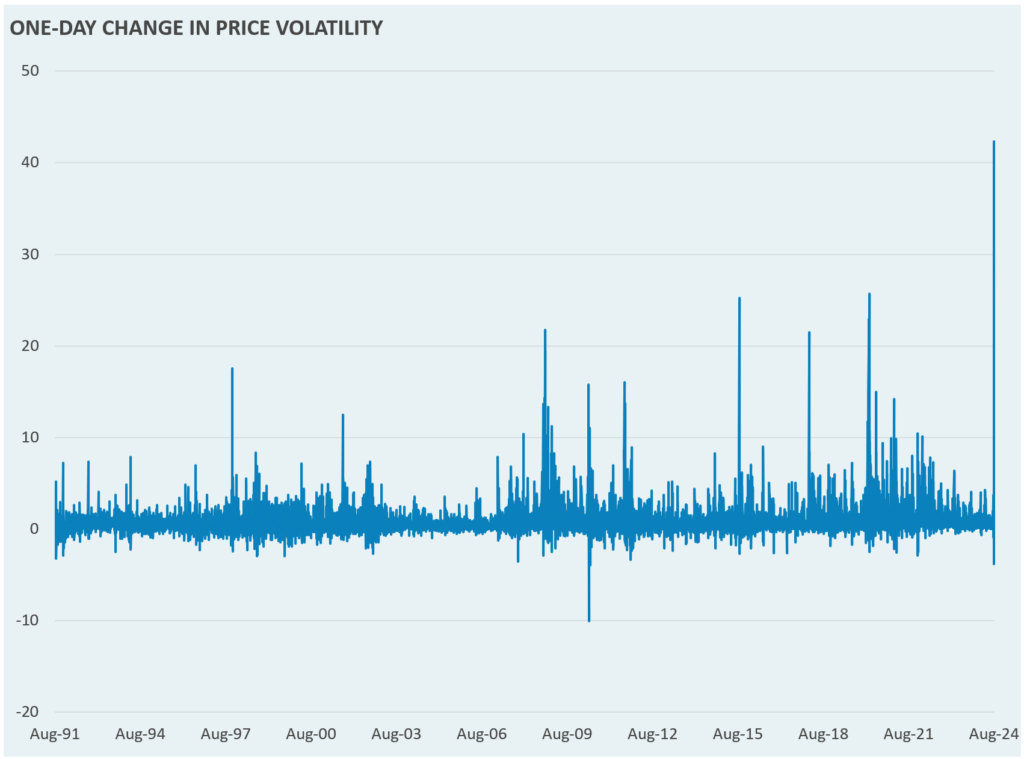

This week’s Market Note outlines the recent spike in volatility, which follows nearly two years of very depressed volatility levels. On Monday, volatility spiked 42 points to 66, beating the previous largest increase following the COVID-19 lockdowns. With valuations trading at multiples around one standard deviation above their historical average, it is not entirely surprising to see some pain start to materialize in markets, although volatility remains likely to drop to more-conventional levels soon.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.