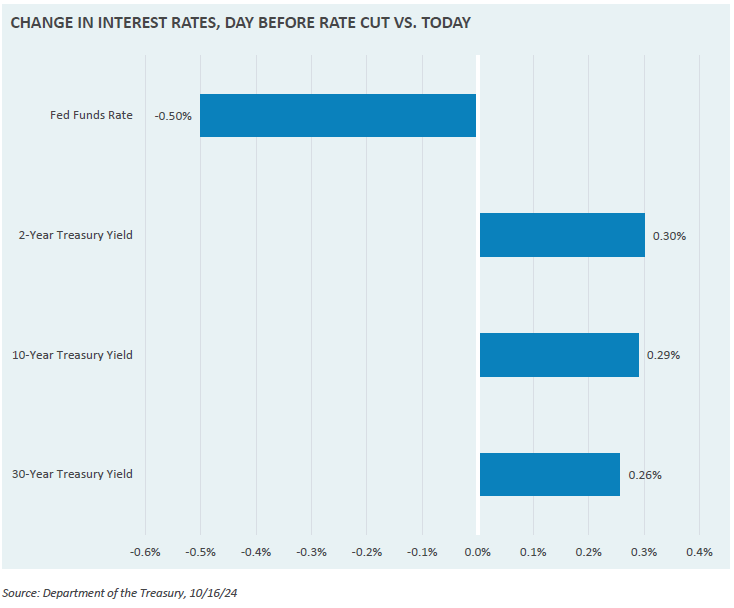

The Federal Reserve finally delivered a long anticipated interest rate cut at their meeting in mid -September. This rate cut gave investors and consumers hope for cheaper borrowing, and some easing of costs after the recent bout of inflation. But since the rate cut, interest rates have headed materially higher. This week’s Market Note examines changes in yields since September 18th.

Certain borrowing rates that are linked to the Fed Funds rate, such as overnight lending by banks and credit cards, likely now reflect a lower interest rate after the Fed’s cut. However, longer-term borrowing rates, including auto loans and home mortgages, are set based on Treasury yields, which have jumped since the rate cut. Competing theories exist regarding why rates have been rising, such as an improved economic outlook, or shifts in U.S. presidential election odds, but one thing is certain―Americans are not yet seeing a material drop in borrowing costs.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.