Executive Summary

Private credit, as we know it today, was popularized by investors seeking yield from credit investments while banks were shifting their lending practices following post-Global Financial Crisis (“GFC”) regulation. This asset class filled the previously bank-led market with privately negotiated, higher yielding securities that fulfilled investors’ yield seeking appetite.

While satisfying investors’ desires for higher yield, private credit securities feature a host of attributes for potential borrowers. Companies that may exhibit elevated complexity, accelerated financings deadlines, or non-traditional capital uses often accept the increased costs and more restrictive documentation of the private finance market.

As a result of this, investors have built portfolios that consist of both public and private credit exposures, which begs the question: with base rates at their highest levels since the early 2000s driving significant yield from fixed income portfolios, where should investors look to buy credit exposure?

In this Topic of Interest, we discuss the benefits of including private credit within an investment program. We also highlight the drawbacks and risks facing the asset class as we look to assist investors in answering the question of where to look for credit exposure.

Private credit: A brief history

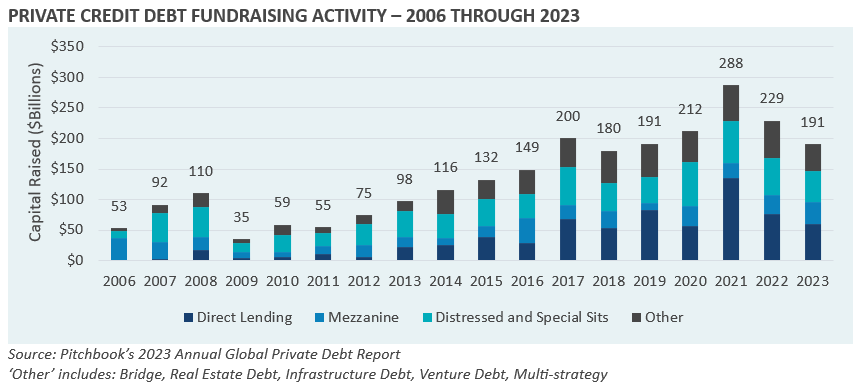

Certain private credit strategies have been prevalent within private capital portfolios predating the GFC. These strategies tended to be more return seeking in nature, targeting high returns using credit and credit-like investment structures. Strategy types included distressed debt, credit special situations, and mezzanine, and were often included within private equity portfolios rather than fixed income or other credit exposure. Capital raising for these strategies peaked in 2008 prior to a significant pullback in capital formation, common across private markets asset classes resulting from the GFC. Private credit experienced limited growth in fundraising in subsequent years as post-GFC regulations were implemented.

As this framework began to evolve in the subsequent years with the introduction and implementation of Basel III and the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”), a nascent asset class, direct lending, began to experience considerable growth. Regulatory restrictions regarding the types of securities that traditional banks could hold began to limit the collective ability of banks to lend to borrowers seeking floating rate debt. In a post-GFC market with base interest rates (LIBOR/SOFR) below 1%, borrowers were seeking options to attain floating rate financing.

So why should investors allocate to private credit?

Historically, investors have looked to the private markets to generate returns in excess of those available via public market investments. In addition to enhanced absolute returns, investors may seek out private credit markets for higher, more stable investment yields, diversification beyond traditional markets, and reduced volatility of returns given the lack of mark-to-market pricing on most securities held within private strategies. The floating rate nature of securities has also been looked to as a possible inflation hedge.

Private credit loans are often structured with enhanced protections relative to traditional, covenant lite or covenant free broadly syndicated loans. More robust structuring may result in lower loss rates as borrower underperformance may be identified well before a financial default due to the presence of maintenance and other covenant protections. The broadly syndicated loan and other traditional credit markets have recently been riddled with lender dynamics where lenders to a single borrower are competing with one another for their individual best outcomes, often in what appears to be a zero-sum game. These dynamics are the result of a lending environment with loan documentation that often does little to restrict the borrower from acting only in the equity capital’s best interest. Private credit tends to have stronger credit documentation that can assist lenders in detecting potential company challenges prior to a payment default and can lead to enhanced returns through early intervention or leading credit restructuring processes, should that be necessary.

Private credit strategies also offer investors return profiles that may combine income orientation with capital appreciation. Private credit portfolio design is paramount to achieving the desired goals from allocations to the asset class. The wide range of strategies and return profiles within the asset class provides investors with a high level of customization and optionality.

Public vs. private credit: how does performance stack up?

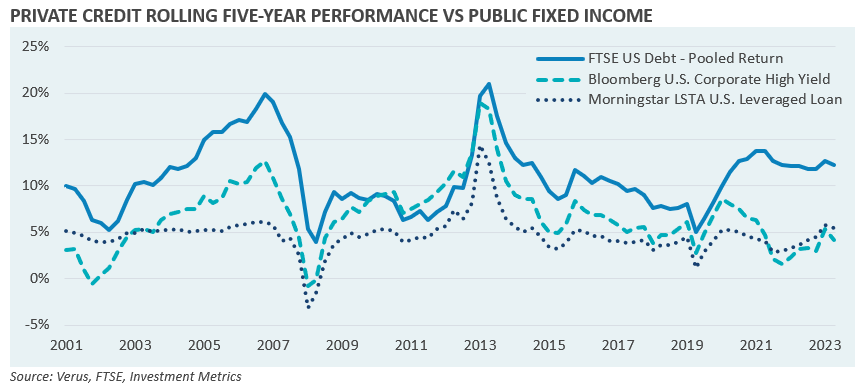

Private credit exposures are often sourced from traditional fixed income allocations, therefore the asset class tends to be benchmarked against the higher risk indexes within public fixed income: bank loans and high yield. When considering U.S. Private Debt pooled manager performance, as measured by the FTSE U.S. Debt Index, over rolling five-year periods dating back to the early 2000s, private credit has outperformed the bank loan and high yield markets 88% of the time, underperforming only subsequent to the GFC given the dramatic spike in absolute performance of the high yield market after the drawdown of 2008.

As rates began to increase in the late 2010s, private credit maintained its return premium over the public credit markets. The dislocation and drop of base rates following the COVID-19 pandemic provided private credit strategies with an opportunity to invest into a volatile market environment. This allowed many funds to generate a significant premium to public markets, one that has been maintained on a trailing basis. Private credit’s consistent outperformance over traditional credit markets across cycles demonstrates the return benefits of the asset class within a broader investment portfolio.

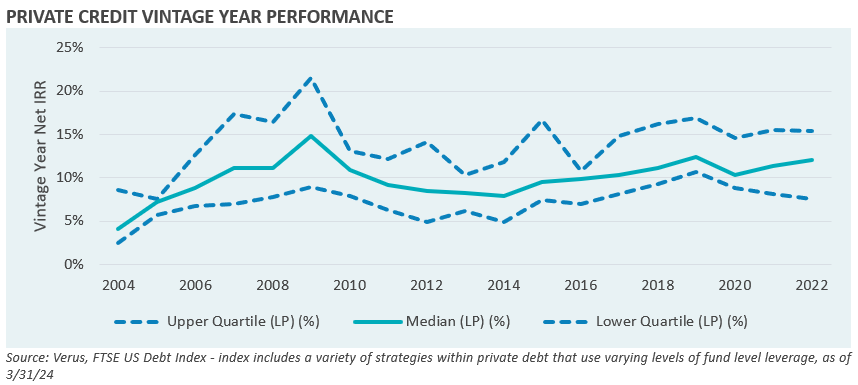

Importance of Manager Selection

As is the case in many private market asset classes, return dispersion between the top and bottom quartiles of managers tends to be considerably wider than what is seen across public market strategies. While private credit as an asset class has on average generated outperformance relative to the public credit markets, bottom quartile managers often struggle to achieve the returns generated by public credit and show significant underperformance relative to top quartile and median managers. Between 2004 and 2022, the average spread in performance between top quartile and bottom quartile U.S. private credit managers averaged 700 basis points. The average spread between median and bottom quartile managers averaged 300 basis points over the same period. As the asset class has on average delivered a median return of 10% over this period, these spreads in performance are particularly wide on a relative basis.

There are many factors that contribute to the success of a private credit fund which potential investors should consider. While these evaluation metrics have similarities to other private markets asset classes, private credit investments are often limited in terms of upside, but with significant potential downside. This suggests that active management requires a unique focus on underwriting standards and effective structure achieved by each manager.

Building a private credit portfolio

Corporate direct lending has been a staple of private credit portfolios throughout the growth of the asset class. As private credit continues to grow within investor portfolios, looking beyond these strategies may result in additional benefits. There are many niche or nuanced strategies within the category of private credit that may provide additional diversification to a portfolio. Asset-based finance strategies, in particular, can offer an enhanced level of diversification for investors. These strategies typically lend against hard assets or pools of financial assets (e.g., mortgages, auto loans, credit card receivables, etc.) and have differing cash flow and structural characteristics relative to the corporate direct lending market.

Private credit offers a higher level of customization relative to many other private capital asset classes. We believe that each investor should design their private credit portfolio with their needs and objectives in mind, rather than being tempted by the hottest strategies in the market at a given time. Building portfolios with complementary collateral exposures and diversified return attribution should benefit investors by providing both return consistency and downside resilience across market cycles.

What risk should investors consider before allocating to private credit?

Like everything, the benefits of allocating to private credit comes with certain risks and considerations. Fundamental credit risk in the asset class may be substantial. Private credit is typically focused on lending to below investment grade quality companies or assets and often at relatively high leverage levels. Should a manager not have strong fundamental diligence practices and robust investment structuring processes, investments of this type can lead to significant losses. In addition, private credit strategies may utilize fund level leverage to amplify returns and yield, further increasing the risk profile of investments in the asset class.

Similar to most private capital investments, strategies within private credit are higher cost than traditional credit strategies, potentially exacerbating underperformance of lower quality managers and portfolios. Illiquidity is another challenge investors face when looking to the private markets, since the costs of liquidating a portfolio of private investments can often exceed the excess returns generated by the manager. As with most private market strategies, an enhanced level of operational complexity exists when implementing the portfolio. Portfolios tend to require multiple investments across sub-asset classes necessitating administrative attention and portfolio monitoring. Finally, while the asset class has proven resilient historically, there has not been a significant down-market cycle for private credit in its current state and crowding within the market may pose challenges for underperforming investments.

We believe that the benefits of a properly structured private credit portfolio outweigh the risks in many cases, especially those resulting from a well-diversified and properly planned approach to implementation of the portfolio. Investors are encouraged to engage with asset class experts when designing private credit exposures to ensure that the design is consistent with expectations.

Conclusions

Investors have the choice between the public and private markets when seeking credit exposure. While the public markets are currently generating high expected returns and yields, significant volatility within the asset class may lower the overall attractiveness. The private credit markets have evolved to provide investors with potentially strong risk-adjusted returns, more muted volatility, and enhanced diversification, among other benefits. Return resiliency, while not tested in a significant down market, has been demonstrated by the asset class and the premiums provided over public credit markets may once again be magnified if interest rates were to fall.

While implementation challenges, increased complexity, and the risks of private credit investments may present an impassable hurdle for some investors, we believe the benefits of the asset class, when implemented properly, can materially improve the risk/return profile of a broader portfolio. For more information regarding our views on approaching private credit allocations, please reach out to your Verus consultants.

Notes & Disclosures

Past performance is no guarantee of future results. This report or presentation is provided for informational purposes only and is directed to institutional clients and eligible institutional counterparties only and should not be relied upon by retail investors. Nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security or pursue a particular investment vehicle or any trading strategy. The opinions and information expressed are current as of the date provided or cited only and are subject to change without notice. This information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. This report or presentation cannot be used by the recipient for advertising or sales promotion purposes.

The material may include estimates, outlooks, projections and other “forward-looking statements.” Such statements can be identified by the use of terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” or the negative of any of the foregoing or comparable terminology, or by discussion of strategy, or assumptions such as economic conditions underlying other statements. No assurance can be given that future results described or implied by any forward looking information will be achieved. Actual events may differ significantly from those presented. Investing entails risks, including possible loss of principal. Risk controls and models do not promise any level of performance or guarantee against loss of principal.