Verus Sound Thinking: Top 10 ideas for 2025 (download the PDF)

Every year Verus identifies a series of topics that we believe will be important for investors to consider during the coming year. Some of those tend to be economics or markets focused, while others tend to focus on geopolitics or other broader issues.

We are relatively unique amongst our peers, though, in that we always begin this document by assessing how well we did in our predictions for the previous year. That helps us refine our thinking. It should also give you, the reader, some confidence that reading these predictions is a worthwhile use of your time.

So: how did we do this year, and what do we expect for 2025?

Scorecard from 2024

2024 was a challenging year for many forecasters. Instead of economic weakness, leading to a recession and rapidly dropping interest rates, we experienced strong economic growth and rates that were higher for longer. Politics was an important part of the year, and the U.S. election resulted in an outcome which was surprisingly clear, even if the level of disagreement in the country remains high.

Despite this, we had a fairly good year in terms of predictions, with 8 out of our 10 predictions able to be marked as successful, and the two we missed relating to topics where we were ultimately glad our forecasts did not materialize.

1. Strongly weak or weakly strong – U.S. economy strong H1 but more concerns H2

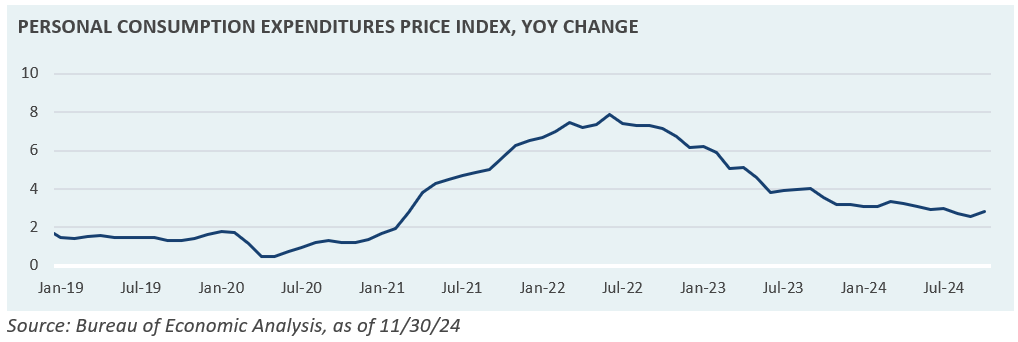

We anticipated that the economy would remain strong during the first half of the year, with interest rate cuts being postponed much further than the market expected. We then expected some signs of weakness would appear during H2, and believed this would allow rates to begin to fall, possibly with market volatility. We expected inflation would come down but would not hit target levels and that it would be bumpy.

This was correct. The economy was strong during H1, but some weaker data began to appear during H2, allowing the Fed to begin to cut rates, but at a much slower rate than the market was expecting. We were lucky and escaped some of the feared volatility because of the strength of the growth. As we expected, inflation did indeed drop but not as much as the market expected, and not in a straight line.

2. Resurgent banking pain due to bond losses on balance sheet

We were concerned that the combination of high interest rates and continued real estate market weakness might cause a confidence crisis within the regional banks. We are happy that this was wrong. Investors and depositors continued to look through to the long-term outcomes and retained confidence in these institutions enough to avoid another crisis of this type. This was likely in part because of continued underlying economic strength which surprised investors and created continued confidence in the solvency of these institutions.

3. International disappointment in economies and markets

We expected that international equity markets would continue to produce disappointment, underperforming the U.S. market, and also producing below-average growth and returns. We can count this as a success. The U.S. as of 12/31, produced a dollar return of 25.0% YTD, while the World ex U.S. produced a return over the same period of only 2.0%.

4. Supply chain vs money supply – sticky inflation

We expected inflation to drop, for that drop to be bumpy, and for the level of inflation at year-end to be above the target rate for the Federal Reserve. This was indeed what happened. We can count this as a success.

5. Global fragility – geopolitics remains “hot”

We expected continuing “hot” geopolitics during the year and that conflict would continue or possibly increase. This was correct. We have continued to see the expansion of regional conflicts, with North Korean troops now in Ukraine, the Middle East conflict continuing, and rising tension between Russia and NATO.

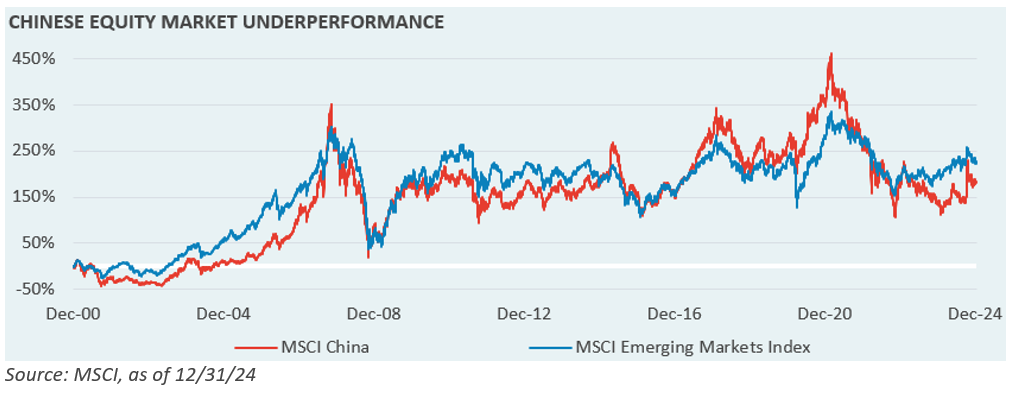

6. Reconsidering China – further weakness and less external investment

We expected to see continued rising tension in China, combined with U.S. investors increasingly questioning the role that China plays in their portfolios. We were also concerned over economic weakness continuing in China, and that this would sharpen U.S. investors’ minds further on this topic. This was correct. We have seen continued escalating tension, continued economic weakness, and continued questioning of allocations to China during 2024.

7. Office real estate – some (but not all) shoes dropped

We expected that office real estate transaction volume would pick up and that liquidity would slowly return to the market, albeit at lower prices reflecting the difficult new reality this space faces. We identified the fact that 2024 and 2025 would likely be good years to begin committing to new allocations in this space, although this would be a slow-burn opportunity. This was correct—transaction volume has increased, with prices in hard-hit markets lower, and we continue to believe in the chance for opportunistic managers to deliver good outcomes. We can count this as a success.

8. Avoiding oops – domestic political disagreement causes unforced error

While the political year was very stressful, we have so far avoided an unforced error stemming from the degree of political heat and leading to a catastrophic outcome. We are glad to be able to count this as incorrect—although the underlying insight (that political stress would be high and that odd things might happen) was clearly accurate in general. The recent Continuing Resolution challenges are just another example that the level of tension in domestic politics is much higher than usual, and that will continue to pose risks.

9. Please show your work – demands for more detailed proof for ESG claims

We expected there would be continuing pressure around ESG, with both pro- and anti-ESG investors asking for more detailed proof from financial services institutions that they are doing (or not doing) what they claim to be doing (or not doing). Over the year, this pressure has indeed increased, and there is increasing litigation both against firms perceived to be involved in greenwashing and against those perceived as overly activist. We expect this pressure will continue to grow in both directions, but for now this counts as a success.

10. Pushing through the pain – private market pain causing liquidity challenges for some investors

We believed that certain parts of the private markets would cause pain, in both the return and liquidity dimensions, for investors who had misjudged their degree and nature of commitment. This has indeed been the case this year, with increasing stories of large, sophisticated investors suffering challenges due to return and liquidity issues, in both non-discretionary and OCIO portfolios. This has validated for us the extensive work we do with private markets pacing studies (i.e., annual capital deployment planning), our Liquidity Coverage Tool, and other resources that we employ to help our clients avoid these challenges. This counts as a success.

So overall for 2024, we had a relatively strong year in terms of forecasting: 8 out of 10 is a good result. We are particularly pleased with that result as the picture we were painting was quite different than many other investors.

2025: Are we back in the mid-1990s again?

So, what do we see for 2025?

The theme that continues to resonate with us most strongly during the latter part of 2024 and as we look ahead to 2025, is that we may be seeing something that rhymes most closely with the mid-1990s. A time of significant technical change, when the U.S. economy and markets were consistently surprising to the upside, when there was talk of “irrational exuberance”, and when political tensions were high, feels very similar to the current environment. While assuming the future will be exactly like the past is foolish, considering parallels between these environments may be instructive.

With that in mind, here are our ten things to think about for the upcoming year.

Up, not down: U.S. economic growth surprises to the upside

The U.S. economy has surprised many with its resilience in a time of rising rates. We believe this surprising economic strength will continue in 2025, even as the term structure and nature of debt further spread the impact of rate rises through the economy. Improving confidence and the potential extension of the Tax Cuts & Jobs Act—or even additional cuts for certain Americans—could provide an additional “animal spirits” boost to economic activity.

Success metric: This will be counted as a success if U.S. real GDP growth for the year exceeds the consensus forecast at the time of writing by more than 25bp (currently 2.1% year-over-year).

Action: Continued economic strength tends to have a fairly direct impact on the path of U.S. equities. Further strength should provide investors with comfort continuing to overweight U.S. risk assets in their portfolios.

Up, not down part 2: continuing stubborn inflation

Continued strength in the economy is likely to help keep inflation at higher levels than most would like, although we certainly do not expect a return to the recent very high levels that we saw during and immediately after the pandemic. Our expectation for stronger economic growth ties into this view, as does the continued effects of recent significant money supply growth and surprising price gains in some parts of residential real estate. We also believe that there may be some inflationary impact from tariffs (although as we say below, this will be a small, not large, effect) and from the continuing trend towards re-onshoring.

Success metric: Success for this will be measured by the PCE inflation metric for the year, staying on average materially above the Fed target range.

Action: Investors should assess the likely effect of higher, but still moderate, inflation on their total portfolio, while remembering that inflation affects a broad range of asset classes including equities, not only traditional “inflation protection” areas.

Higher, not lower: normality resumes

An expansionary economy with slightly too hot inflation will likely keep interest rates higher than expected. While we expect the Fed to continue their cutting cycle, for now we do not expect that cycle to last for long. We expect the Fed to pause rate cuts during 2025, and depending upon the path of inflation could even see a small rate rise at some point towards the end of the year, although this remains a low probability. The Fed only affects the short end of the curve directly, of course, and the curve as a whole will likely continue to normalize, with rates at the longer end remaining stable or moving somewhat upwards.

Success metric: Success for this will be measured by the Fed Funds rate being no lower than 3.75% by the end of the year.

Action: We believe investors should remain wary of going long duration and should stick to policy or shorter in fixed income portfolios.

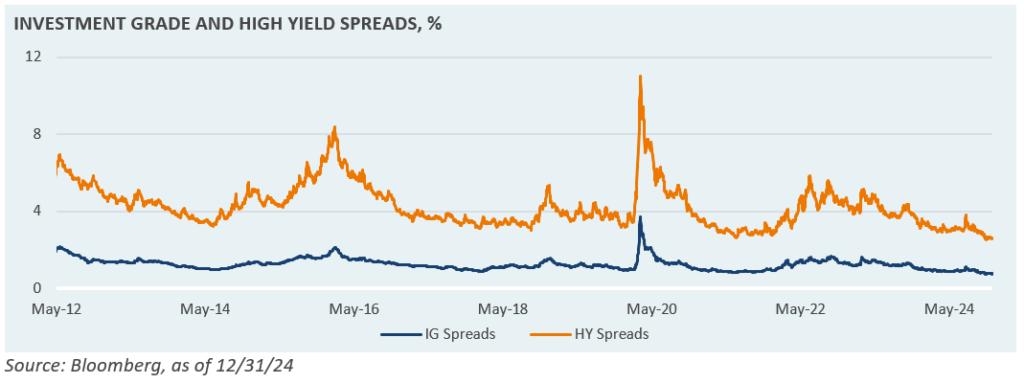

Tight for a reason: opportunities still available

Credit spreads for traditional credit remain historically tight, as they have been for some time. The market is pricing in low default probabilities, and this view seems appropriate based on recent default activity and the outlook for credit markets. The result is limited performance upside offered to investors and little cushion if defaults pick up: not a negative environment for credit, but also not one where investors are likely to make windfall returns. There remain opportunities in credit, but to achieve these, investors will need to look at more complex areas of the market or portfolio management approaches—structured credit, multi-asset credit, private credit, and so on—though these opportunities tend to be more complex and potentially expensive to access.

Success metric: Credit spreads will end the year no tighter than they are now, and likely somewhat wider.

Action: We believe investors should limit their vanilla credit exposures and focus more of their portfolio on well-chosen structured/multi-asset/private credit opportunities.

Seriously, not literally: Trump 2

Trump’s victory is likely to have significant consequences, with the new administration already showing signs of being more focused and organized than before, and driving more change in both policy and approach than during the first term. Investors will need to think hard about the policies being discussed and announced over the next four years, remembering that during Trump 1, an approach of taking him “seriously but not literally” was generally effective. This involves ignoring most of the noise from the administration (and press coverage) and assuming that most communication is done in bold colors to communicate a broad message, with the details of the final implemented policy being more subtle and nuanced. This is generally a good approach to take to all policy communication, but with the current heated rhetoric, it seems particularly appropriate.

Success metric: While difficult to identify exactly, we can count this as a success if by the end of 2025 we can identify a number of major, controversial, policy propositions where the eventual implementation has turned out to be more nuanced and successful than the initial announcement or commentary about those policies by the White House or their opponents.

Action: We believe investors should focus on the details of policies once implemented and should assess policies with the assumption that interpretations of policies that sound “too bad to be true” are as unlikely to be correct as those that sound “too good to be true”.

Free(ish) trade: putting the IF in tariff

Tariffs are back on the agenda and seem to be one of the most important tools the new administration wants to wield. In line with the “seriously not literally” approach outlined above, it appears most likely that the use of tariffs, although out of line with the approach taken over most of the last 30 years, will be considered and strategic, not unthinking and across the board. We have already seen the first sign of the threat of specific tariffs against specific countries and industries being used as a negotiating tool for targeted goals – we expect this to continue and for tariffs to be applied as one of many tools to improve terms of trade against a range of countries. This approach may have only a limited inflationary effect, and if successful, could help deliver domestic economic growth to counteract some of the unavoidable detriments. Tariffs carry risks, as do many tools, but we believe investors should avoid excessive concern over their impact until we see evidence that an overly broad approach is actually being implemented, rather than simply being talked about as part of a negotiation.

Success metric: This prediction will be successful if tariffs have been implemented in certain places for specific reasons, but not across the markets as a whole on an unconsidered and untargeted fashion.

Action: We believe investors should discount excessive inflation or trade disruption concerns when assessing market opportunities.

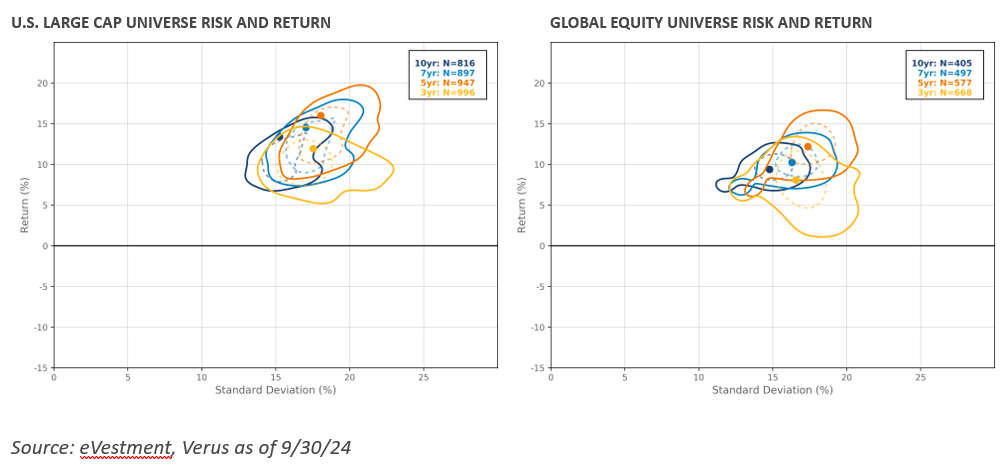

Active risk: global opportunities

U.S. equity markets remain very difficult for actively managed funds to outperform, and recent market concentration in the Magnificent 7 have made that problem worse. While we expect some of this concentration to correct over time, we believe that the structure of portfolios with dedicated U.S. active equity buckets makes it particularly hard for investors to achieve outperformance, as it incentivizes active managers to overly-diversify their portfolios when trying to capture alpha in the market. We believe that active global equity portfolio allocations can counteract this problem, allowing the investment manager only to invest in the parts of the U.S. market that are most attractive, allocating elsewhere when there is better opportunity. We also believe that 2025 is likely to present a particularly attractive environment for a global approach, given the security level disparity and surprise that seems possible given the rapid changes in the economic, technical and regulatory environment.

Success Metric: We expect to see strong security selection value added from the U.S. component of Global Equity portfolios during 2025, and continued difficulties in equivalent active U.S. equity long-only portfolios.

Action: We suggest investors consider including a global active equity sleeve in their equity portfolio where appropriate, allowing them to increase security selection alpha from their U.S. allocation given the challenging domestic security selection environment.

Crypto clarity: the call is coming from inside the house

A number of years ago we wrote about crypto saying that the nature of the assets remained poorly understood, and that regulatory uncertainty and opposition from regulators meant that it remained too early for these assets to justify a place in institutional portfolios. Since then, the market has changed and there has been increasing regulatory certainty which has gone so far, recently, as the SEC approving the launch of spot cryptocurrency ETFs. The new administration has been very clear about their fondness for crypto and has been positive in particular about bitcoin. It seems clear that those officials who replace Gensler at the SEC and others across government agencies are likely to be actively positive on crypto. This is a significant shift in the regulatory environment, and once the actual regulatory agenda becomes clearer, many more institutional investors may begin considering whether crypto has a place in their portfolios. There will remain hurdles: pricing models remain if not speculative then at least novel, and it remains unclear whether a new, more positive regulatory approach to crypto will apply to all markets or simply those (like bitcoin) which seem to be primarily a store of value rather than functionally more targeted as a medium of exchange. Either way, by the end of the year we believe crypto will be on the table as a discussion topic for institutional portfolios, even if the conclusion for many investors remains that it is still too early to allocate.

Success metric: A positive regulatory agenda around crypto will be put in place, and bitcoin will be identified as a potentially appropriate asset for institutional investors to consider for portfolios.

Action: Once the regulatory agenda is clearly expressed and has begun to be implemented, investors with a higher level of risk tolerance may choose to begin to consider whether crypto may have a role in their portfolios and what that role may look like.

U.S. small caps: strength matters

Although the investment literature holds out hope for a small cap premium, reality tells us that this premium appears only sporadically. Small caps, generally speaking, derive a great deal of revenues domestically, and therefore may be more directly affected by changes in policy from the new administration. At first glance, this might suggest that investors should brace for a U.S. small cap comeback. However, closer research brings out the fact that the small cap universe is very diverse, with many companies included in it being structurally unprofitable, and that small cap companies are already very expensive relative to history. We believe that there will be opportunities for successful small cap companies during 2025 in the U.S. if we do indeed see policy shifts towards less regulation and greater growth – but we are less convinced that this will mean outperformance for the asset class as a whole. Instead, it may simply mean greater opportunities for skilled active managers. Our suspicion is that there will be better than average performance for the asset class, that active manager stock selection alpha will be higher than average, but that large cap will also do well and that this will be more of a rising tide lifting all ships market than specifically a small cap success story.

Success metric: Small cap U.S. equity will perform roughly in line or worse than large cap U.S. equity as a whole but will continue to show higher volatility. Active small cap managers who have previously shown stock selection skill will do better than normal during 2025.

Action: Investors with small cap allocations at a policy level of their portfolio should ensure that they have confidence in the managers they are using to take advantage of possible opportunities in this asset class.

China: is evitable even a word?

The growth of China into one of the largest economies in the world over the last 30 years has been astonishing, and investors have allocated assets to China as a part of the Emerging Markets, in part because of their expectation that this rise will continue, and that a strong China is inevitable (and also that this will translate to equity outperformance, which has unfortunately not been the case at times). The last few years have made it clear, however, that while China will remain large, there are significant structural challenges to their system and economy. The country faces demographic decline, there is too much leverage in the system, and balancing the CCP’s desire for control and stability with a capitalist desire for shareholder profit looks to be a much harder task than some originally thought. At the same time, the political conflict and differences in fundamental approach to various moral and ethical issues have grown and become clearer. The end result has been an increase in interest from investors in products that exclude China altogether. While we do not necessarily see a strong investment case for excluding China completely from an allocation, we believe this trend is likely to continue and we note that exclusion would generally appear to have little likely effect on risk and returns at the total portfolio level. Increasingly, investors are finding that for them, the regulatory and/or ethical problems that come with holding Chinese assets outweigh the benefits of a China allocation for their own portfolios. Excluding China will become an increasingly popular way to avoid the consequences of these risks.

Success metric: We expect to see continuing searches from institutional investors for EM ex China products, and an increasing number of managers offering this product.

Action: We have no specific action to recommend for this item, but we believe investors should be clear about the approach they are taking to China exposure and the reasons for that approach―whether for ESG reasons, regulatory concerns, or simply due to pessimism around Chinese markets.

Conclusion

2025 is likely to be an interesting year. There will be material opportunities for investors, combined as always with some threats. Our base case is for continued economic strength in the U.S., with slightly higher-than-target inflation and interest rates that stay more elevated than the market would prefer. There remains the chance of downside, driven by policy failure, geopolitical risk, or broader economic factors.

We hope this guide will help you focus on some of the key topics that are likely to matter this year. As always, a focus on simplicity, clarity, good planning, good risk management and excellent communication is likely to be at the heart of successful investment strategies.