Markets experienced sizable volatility earlier this week, when U.S. tariffs had been announced against Canada, Mexico, and China, but had not yet gone into effect. The Trump Administration had promised 25% tariffs against Canada and Mexico, our two largest trading partners, unless material steps were taken to curb the flow of fentanyl and illegal immigration into the country. In a last minute deal, tariffs were delayed until March 1, after both countries made concessions to the United States on these issues. The additional 10% tariff on Chinese products did go into place, although negotiations are expected to continue between administrations.

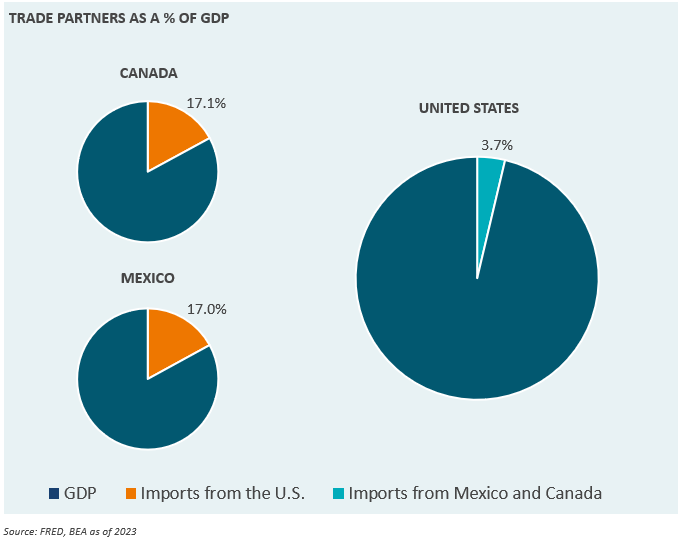

This week’s Market Note sheds some light as to why Mexico and Canada may have been quick to come to an agreement and avoid the implementation of tariffs. The United States relies far less on trade from these countries, as illustrated by each chart of total GDP vs. trading partner imports. A trade war with the U.S. could quickly plunge the economies of Mexico and Canada into recession, due to the size and scale of U.S. imports. The effects of imposed tariffs on the U.S. would likely be milder in nature.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.