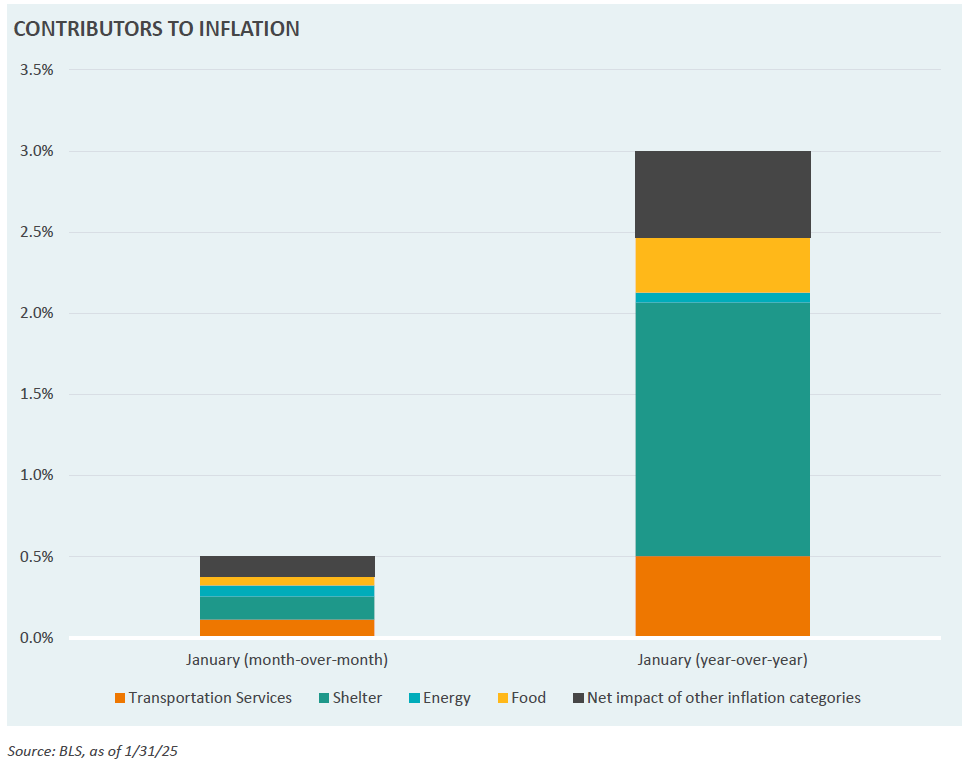

Yesterday’s consumer price index (CPI) report came in above expectations of a 2.9% increase, with a year-over-year reading of 3.0%, the highest since May 2024. The month-over-month number also grabbed attention, as it came in at 0.5%, which is the highest since August 2023. Throughout 2023 and the first half of 2024, inflation had consistently ticked down but has reversed and moved upward in recent months. Shelter continues to be a significant driver of inflation, contributing over half of the overall year-over-year inflation figure, despite making up just a third of the inflation basket. Transportation services are also a key contributor, driving over 15% of total inflation, despite making up just over 6% of the basket.

This week’s Market Note looks at the contributors to inflation, on both a month-over-month and year-over-year basis. January’s uptick in inflation has led to an increase in U.S. Treasury yields, especially on the long end of the curve. Markets now only expect one interest rate cut in 2025.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.