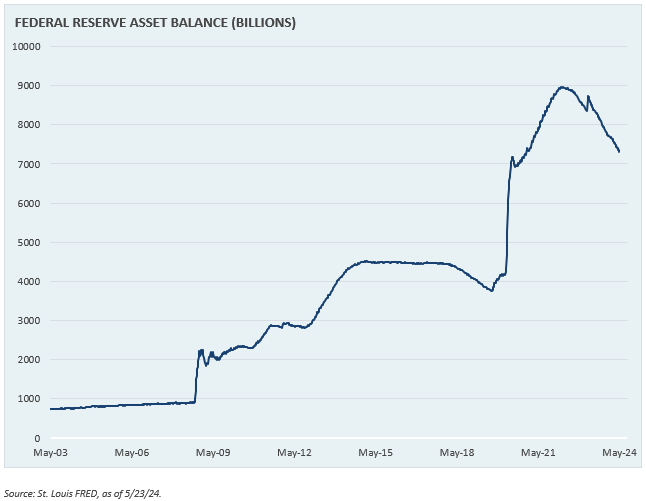

Following the lockdowns brought on by the COVID-19 pandemic, the Federal Reserve rapidly increased the size of their balance sheet. This entailed purchasing both treasury and mortgage-backed securities, which helped keep interest rates low and provided liquidity for the financial system.

In June 2022, the Fed implemented quantitative tightening. This meant that securities would be allowed to mature, and the proceeds would not be invested in new bonds, shrinking the size of the balance sheet. The intended effect of this was to reduce liquidity in the market and to cool economic activity, as well as inflation.

At the May 2024 FOMC meeting, the Fed began slowing the rate of balance sheet reduction, lowering the cap on monthly security runoff from $95 billion per month to $60 billion. There have been no objective parameters established for when the reduction will stop, with the Fed stating they will stop allowing securities to fall off when reserves move from an “abundant supply” to an “ample supply”.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.