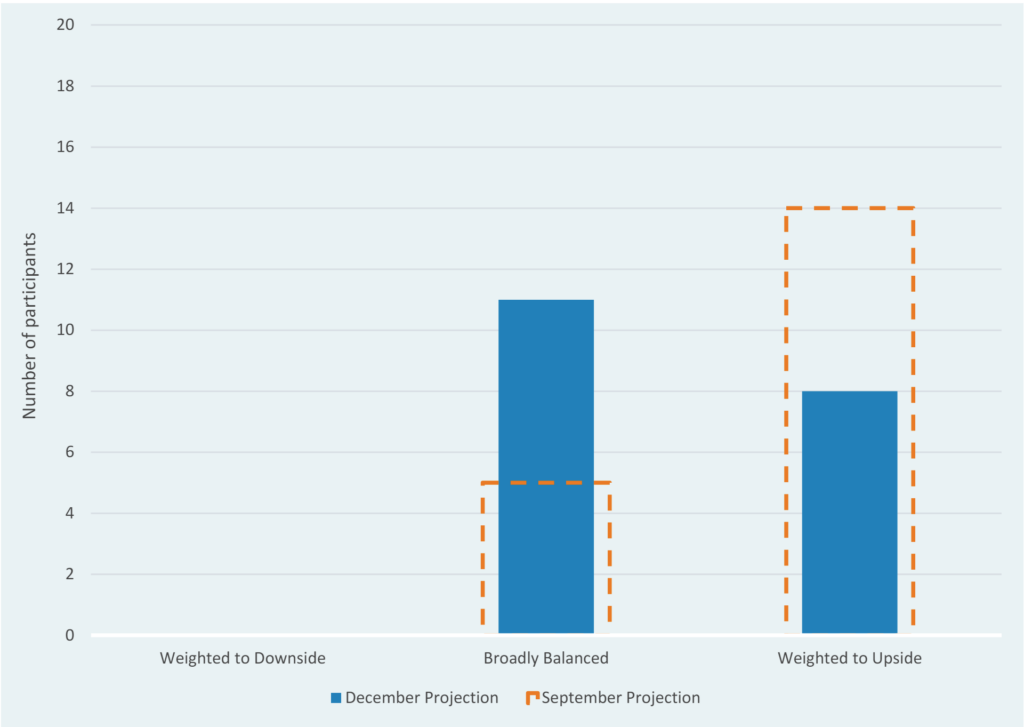

On December 13th, the Fed’s tone shifted. Powell spoke to a much rosier inflation picture and described a Fed that is focused on both sides of its dual mandate, price stability and full employment. Although optimistic, Powell’s comments also emphasized a cautious view of the restrictive policy’s impact, “Our actions have moved our policy rate well into restrictive territory, meaning that tight policy is putting downward pressure on economic activity and inflation, and the full effects of our tightening likely have not yet been felt… Given how far we have come, along with the uncertainties and risks that we face, the Committee is proceeding carefully.”

The Fed may well change course again, but markets have reacted by pricing in a higher chance of achieving a soft landing—which has supported the rally we’ve seen in risk assets.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.