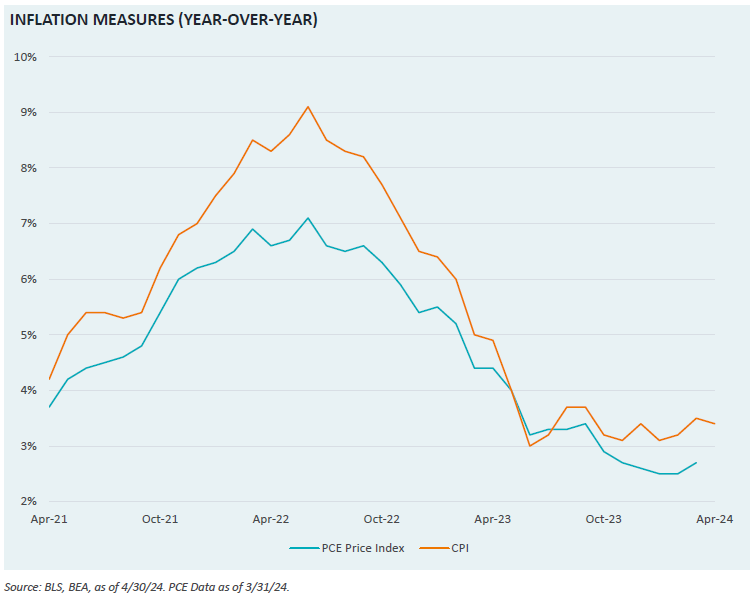

April’s CPI print saw a 0.3% month-over-month increase across both the headline and core measure – bringing the year-over-year readings down to 3.4% and 3.6%, respectively. While the lowest core print in three years bolstered market expectations for two rate cuts by year end, continued price pressures in the services basket presents a challenge for inflation to continue its path towards two-percent.

While CPI inflation remains above three percent, readers may notice that the PCE Price Index, the Fed’s preferred inflation metric is much closer to the Fed’s target, although recently has begun to rise.

The differences between the two metrics are because they take slightly different approaches to measuring inflation. For example, shelter’s weight is about 15% for the PCE gauge, contrasting to a 33% weight in CPI. These differences in calculation method matter, but investors should focus on the broad story the metrics are telling about inflation rather than getting caught up in a single value of a single metric.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.