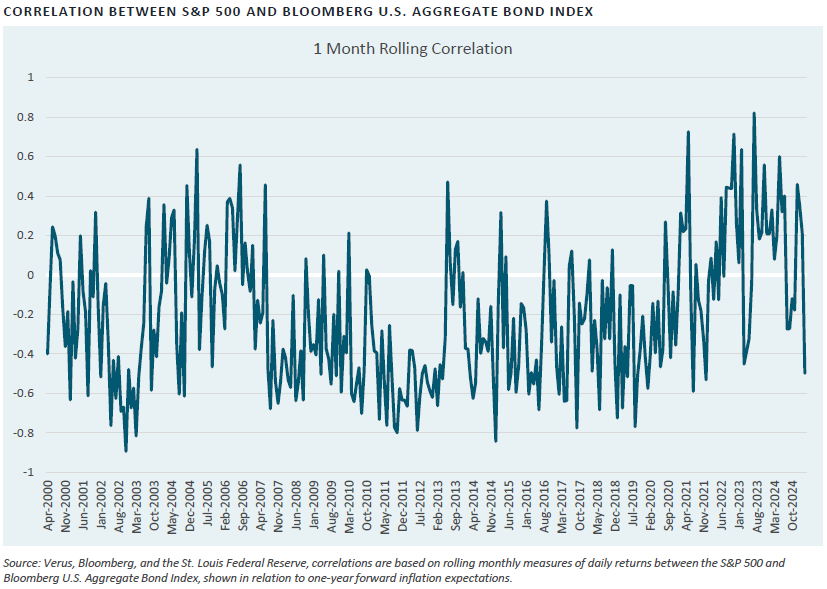

In this week’s Market Note, we illustrate how bonds have continued to offer some diversification benefits to equities, but the relationship has been weaker than some investors expected during recent market turbulence.

The S&P 500 experienced volatility as investors reacted to ongoing concerns about inflation persistence, shifting Federal Reserve expectations, and geopolitical tensions. At the same time, yields on U.S. Treasuries moved higher as bond prices fell. As a result, both equities and bonds posted negative returns at the same time at various points during the month – a dynamic that challenges the traditional diversification role of bonds.

This market behavior highlights the importance of understanding the variability of effectiveness of diversification strategies. No diversifier is perfect, and sometimes even well-diversified portfolios suffer losses across multiple asset classes.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they do not constitute investment advice or a recommendation to buy, sell or hold a particular security or pursue a particular trading strategy.