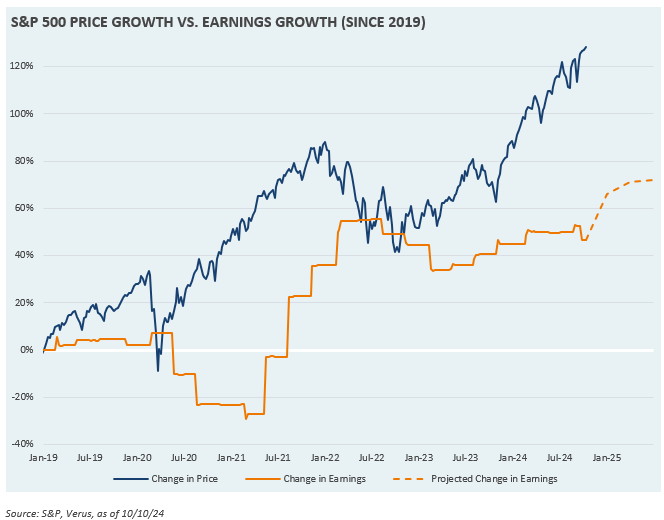

As markets have rallied since the beginning of 2023, concerns have been building around high S&P 500 valuations. Investors are currently paying 24 dollars per one dollar of expected earnings (reflected in a 24 Forward Price/Earnings ratio). Valuations are in the 94th percentile relative to history, meaning multiples have only been this expensive 6% of the time. However, higher valuations could arguably be justified by high earnings growth forecasts, driven by innovations in artificial intelligence as well as a U.S. economic soft landing that seems likely.

This week’s Market Note takes a look at S&P 500 price movement since early 2019, and the path of earnings during that time.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.