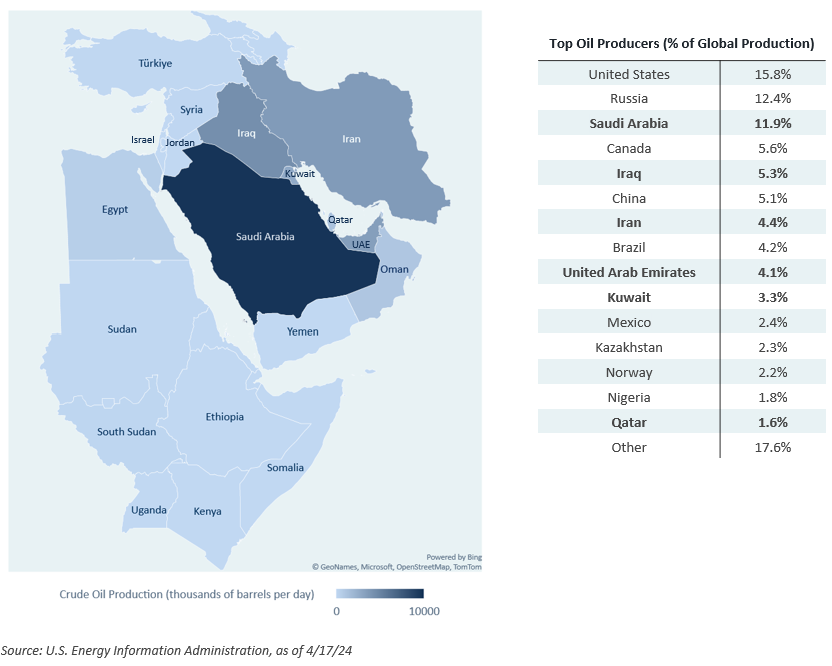

Saturday’s direct attack from Iran on Israel risks a shock to global energy markets if the conflict escalates. Here we take a look at which countries in the region produce the world’s oil, to evaluate the extent of any potential supply disruptions due to furthering conflict.

The main players in the conflict produce a relatively small slice of global oil production, though incremental shocks to oil production in the past have often led to large moves in energy prices. Stronger alliances in the Middle East with western nations likely reduce the chance of an oil embargo and some other dynamics that helped lead to the 1970s energy crises.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.