Federal Reserve Chair Jerome Powell spoke this morning at the Jackson Hole Symposium saying, “the time has come” to lower interest rates. Powell did not speak to the magnitude or pace of rate cuts, but said that future data on labor and inflation would guide the decision-making process.

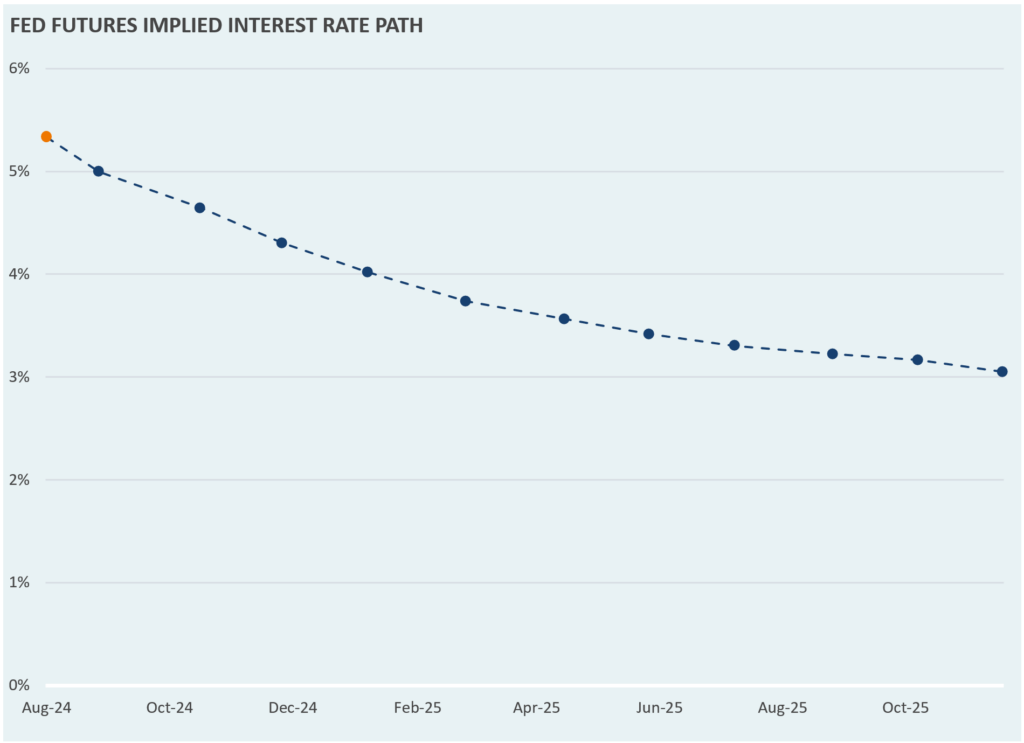

This week’s Market Note looks at the market’s expected path of interest rate cuts through 2025. The market is currently expecting four interest rate cuts before the end of the year, with a 30% chance of getting a 50 bp rate cut at the September meeting. However, the four rate cuts currently priced in this year seem aggressive, given the relative strength of the labor market and some progress left before the Fed hits its inflation target. Whether or not we get those four rate cuts will depend on inflation continuing down towards the Fed’s 2% target, and if any relative weakness begins to show in the labor market.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.