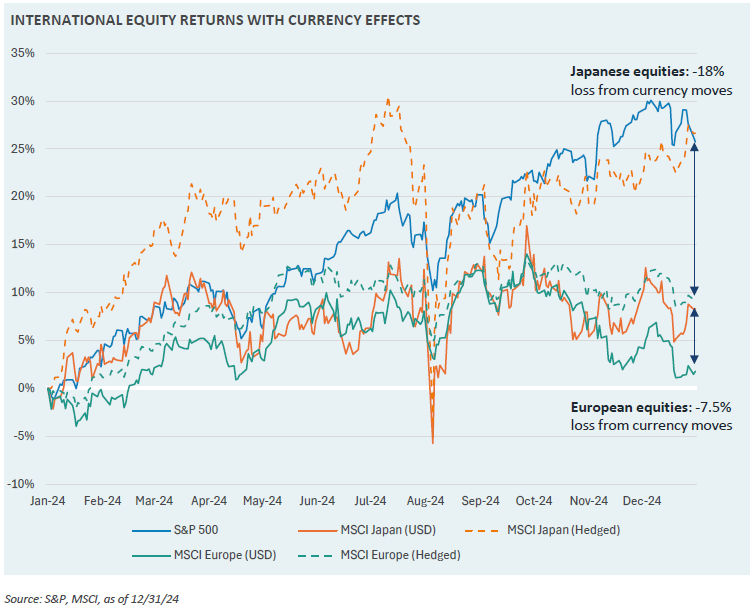

At first glance, U.S. equities might appear to have done exceptionally well in 2024, while non-U.S. equity returns were poor. However, this was not the case—most of the poor total return of non-U.S. equity was caused by currency movements, rather than equity market returns. For U.S. investors with a currency hedging program in place, European equities delivered +9.3% (rather than +1.8% which unhedged investors received). Japanese equities outperformed the U.S. equity market, at +26.6% (rather than +8.3% unhedged). These large losses were the product of appreciation in the value of the U.S. dollar, given heightened growth expectations, firmer inflation, and results of the election.

This week’s Market Note illustrates the importance of distinguishing between the equity market return of international investments and the currency market impact on performance, for U.S. investors with unhedged exposure. Also, it suggests that misunderstanding these currency effects may lead investors to incorrectly assume that U.S. equities have vastly outpaced other markets and are therefore primed for a pullback.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.