After the February tariff scare ended in a one-month delay, that delay has unfortunately ended and U.S. tariffs have been rolled out against Canada, Mexico, and China. Retaliatory tariffs have been swift, and investors now face a potential trade war. This uncertainty has hit asset prices, as business confidence deteriorates and no outcome is in sight regarding a resolution. Additionally, recent economic data releases suggest a slowdown in the job market, spending, and possibly the overall U.S. economy. The combination of trade uncertainty and economic weakness has spooked markets.

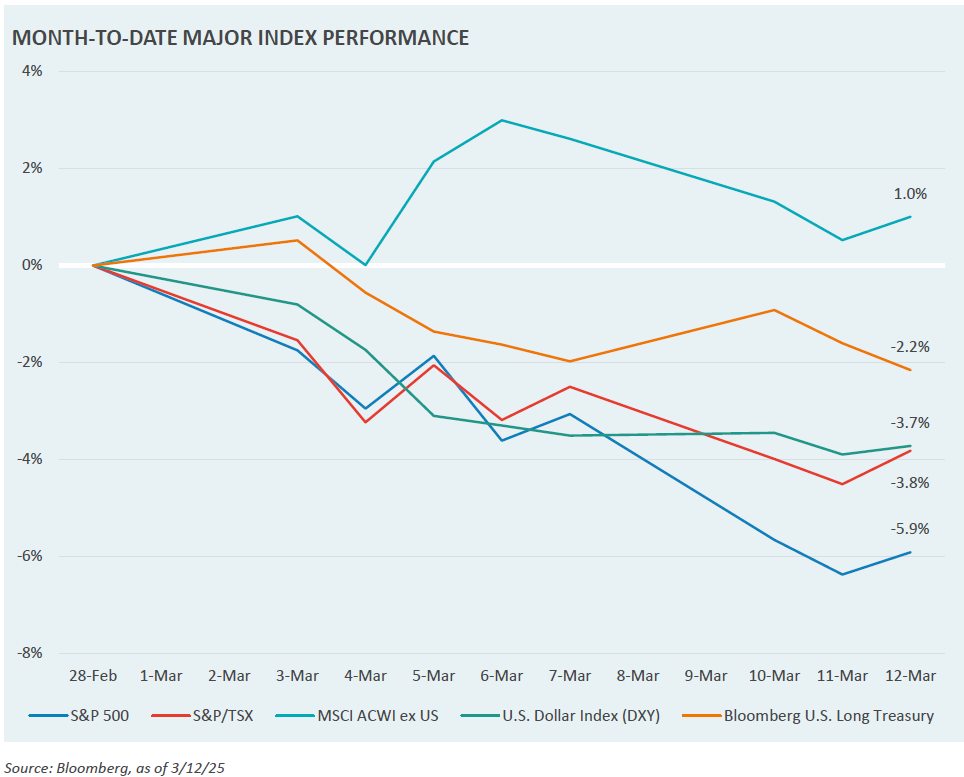

This week’s Market Note examines the reaction from equities, longer-dated treasuries, and the U.S. dollar to changes in the narrative. While the aim of negotiations is to improve trade terms for the U.S. and strengthen domestic industry, it is unclear how negotiations are progressing and whether either of those goals will be achieved.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they do not constitute investment advice or a recommendation to buy, sell or hold a particular security or pursue a particular trading strategy.