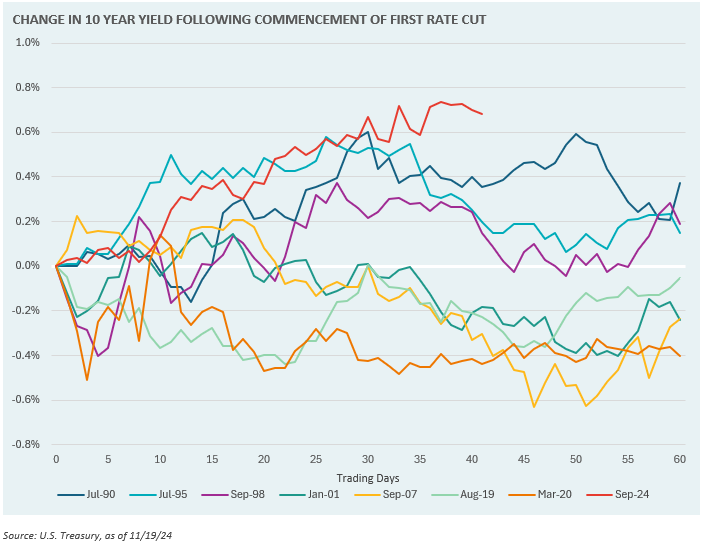

Investors expected longer-term bond yields to drop or stay stable as the Fed began rate cuts, with the anticipated effect being lower borrowing costs for homes, autos, and businesses. Instead, bond yields rose significantly, more than in any rate-cutting cycle in the past 35 years. This jump is likely due to stronger-than-expected economic data, firmer inflation reports, and assumptions about the Trump administration’s impact on growth and inflation.

In this week’s Market Note, we compare recent 10-year U.S. Treasury yield movements to past rate-cutting cycles.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.