Yesterday’s CPI print overshadowed other weekly economic data releases, with hotter-than-expected inflation shifting rate expectations higher—resulting in spiking yields, equities trading lower, and dollar strength. Additionally, Fed Fund Futures are now pricing in two rate cuts by the end of 2024, below the three cuts signaled from the FOMC’s March Summary of Economic Projections.

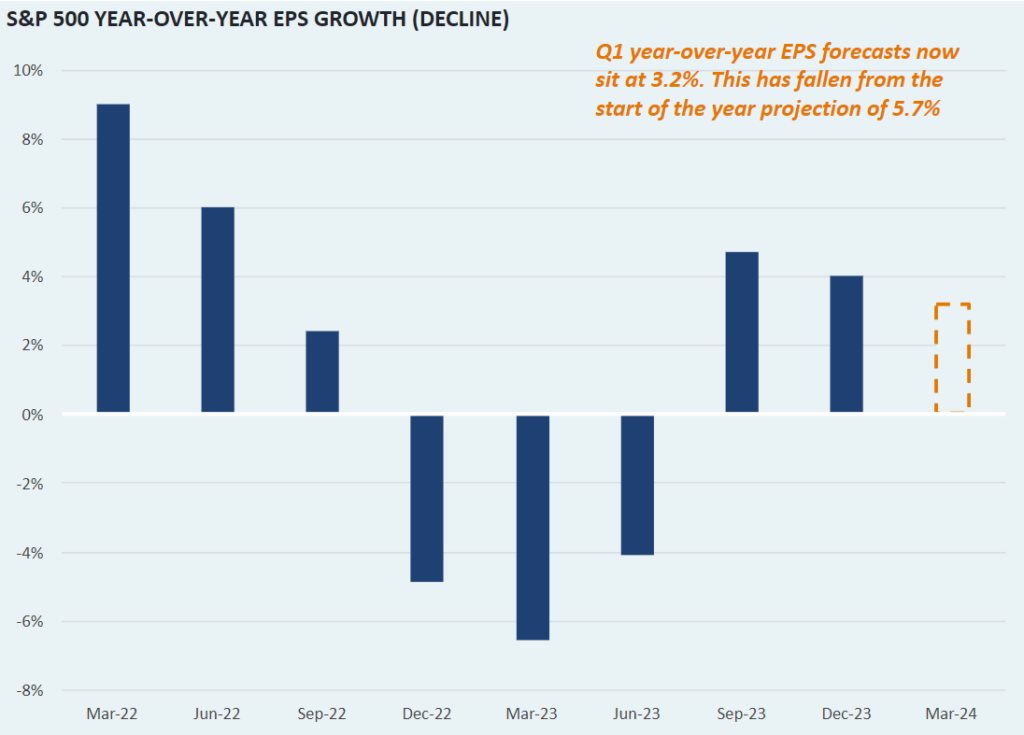

While the CPI release has been the focus for most market participants, investors should be aware that Q1 corporate earnings season officially kicks off on Friday, as large banks including J.P. Morgan, Wells Fargo, and Citigroup report before the open. Expectations for earnings growth remain positive, with forecasts pointing towards 3.2% EPS growth on a year-over-year basis. Market participants will be particularly keyed in this quarter, as valuations remain high while aggregate metrics point towards slowing (yet positive) economic growth.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.