Executive Summary

Historically, investments in privately held assets have generally produced higher returns than those in publicly traded assets. However, sustainable outperformance for limited partners (LPs) requires active allocation, and the dispersion of returns across LPs tends to be very wide.

The broader investment community often cites the ‘illiquidity premium’ as a compelling reason for alpha and value add in private market returns. Verus believes that illiquidity is not a primary driver in generating excess returns. Rather, institutional investors must gain comfort in dealing with the liquidity issues associated with private markets. Excess returns mostly come from concentration and manager skill.

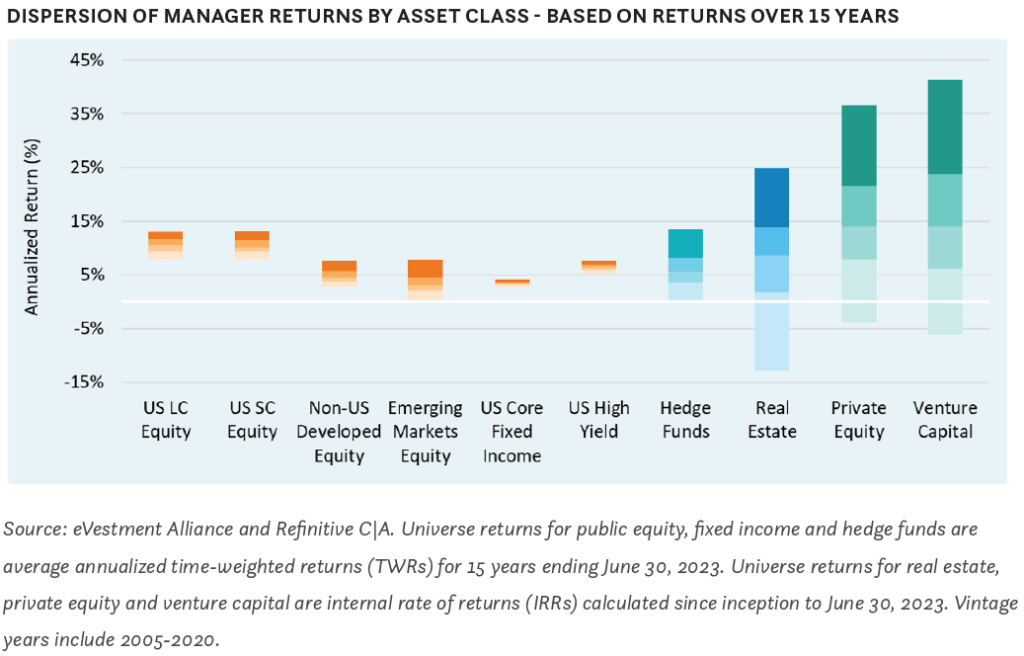

Compared to the public markets universe, there exists significant dispersion of returns between top quartile and bottom quartile managers across each private markets asset class. This has been most pronounced in venture capital (VC) and private equity (PE).

Understanding the role of private markets managers

Private markets managers play a crucial role in the investment ecosystem. General partners (GPs) are responsible for sourcing investment opportunities, conducting thorough due diligence, structuring deals, and managing the portfolio through exit. An exceptional manager not only excels in these areas but also demonstrates a deep understanding of industry trends, has a robust network of relationships, and possesses the acumen to adapt strategies in response to shifting market conditions.

There are a few key due diligence processes that can help maximize the likelihood of consistently selecting top quartile managers.

The importance of track record

One of the most critical factors in evaluating private markets managers is their track record. Historical performance provides a window into a manager’s ability to generate returns and manage risks. However, it is essential to look beyond headline figures and consider the context in which returns were achieved. This includes examining the economic environment, the types of investments made, and the strategies employed. A consistent track record of success across different market cycles often indicates a manager’s resilience and skill.

Assessing investment philosophy and strategy

An exceptional manager will have a clear and coherent investment philosophy and strategy. This should be well-articulated and supported by a logical framework that explains how value is created. Investors should look for managers who can demonstrate a disciplined approach to investment selection and portfolio construction. This includes a well-defined process for sourcing deals, conducting due diligence, and managing investments post-acquisition. Additionally, managers should be able to articulate how they mitigate risks and capitalize on opportunities.

The role of team and culture

The strength and cohesion of the management team are paramount in determining the success of a private markets manager. A high-performing team will have a complementary mix of skills and experience, with clear roles and responsibilities. It is also important to assess the stability of the team, as high turnover can be a red flag. The culture of the organization should foster collaboration, innovation, and ethical behavior. A strong culture can be a significant driver of long-term success and alignment of interests between the manager and investors.

Network and deal flow

Access to high-quality deal flow is a distinguishing feature of exceptional private markets managers. This is often driven by a robust network of industry contacts, including entrepreneurs, corporate executives, and other investors. A manager’s ability to source proprietary deals and gain early access to attractive investment opportunities can significantly enhance returns. Therefore, assessing the breadth and depth of a manager’s network is a critical component of the due diligence process.

Operational capability and value creation

Beyond sourcing and executing deals, exceptional managers add value through active portfolio management. This includes strategic guidance, operational improvements, and market positioning to drive growth and profitability. Investors should seek managers with a proven track record of operational excellence and value creation. This involves assessing case studies of past investments and understanding how the manager has influenced outcomes positively.

Alignment of interests

Alignment of interests between managers and investors is crucial in private markets. This can be achieved through various mechanisms, such as LP friendly fees and terms, investment professionals’ personal skin in the game, and clear communication. A manager’s commitment to aligning their interests with those of their investors often indicates a long-term perspective and dedication to achieving shared goals.

Due diligence process

The due diligence process is critical to selecting exceptional private markets managers. This involves a comprehensive evaluation of the manager’s track record, investment philosophy, team, network, operational capability, and risk management practices. Investors should also conduct reference checks and seek feedback from industry participants. A thorough due diligence process helps to mitigate risks and increase the likelihood of selecting managers who can deliver superior returns.

Conclusion

Picking exceptional private markets managers requires significant pattern recognition and experience. It necessitates a deep understanding of the investment landscape, rigorous analysis, and the ability to identify the qualitative and quantitative factors that drive success. By focusing on track record, investment philosophy, team strength, network, operational capability, risk management, and alignment of interests, investors may enhance their chances of selecting top-tier managers that can navigate the complexities of private markets and deliver outstanding returns.

In short, the journey to selecting exceptional private markets managers is fraught with challenges, but the rewards can be significant. By adhering to a disciplined and comprehensive approach, investors can uncover the gems in the private markets space and position themselves for long-term success. For more information regarding our thoughts on private markets manager selection, please reach out to your Verus consultants.

Notes & Disclosures

Past performance is no guarantee of future results. This report or presentation is provided for informational purposes only and is directed to institutional clients and eligible institutional counterparties only and should not be relied upon by retail investors. Nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security or pursue a particular investment vehicle or any trading strategy. The opinions and information expressed are current as of the date provided or cited only and are subject to change without notice. This information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. This report or presentation cannot be used by the recipient for advertising or sales promotion purposes.

The material may include estimates, outlooks, projections and other “forward-looking statements.” Such statements can be identified by the use of terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” or the negative of any of the foregoing or comparable terminology, or by discussion of strategy, or assumptions such as economic conditions underlying other statements. No assurance can be given that future results described or implied by any forward looking information will be achieved. Actual events may differ significantly from those presented. Investing entails risks, including possible loss of principal. Risk controls and models do not promise any level of performance or guarantee against loss of principal.