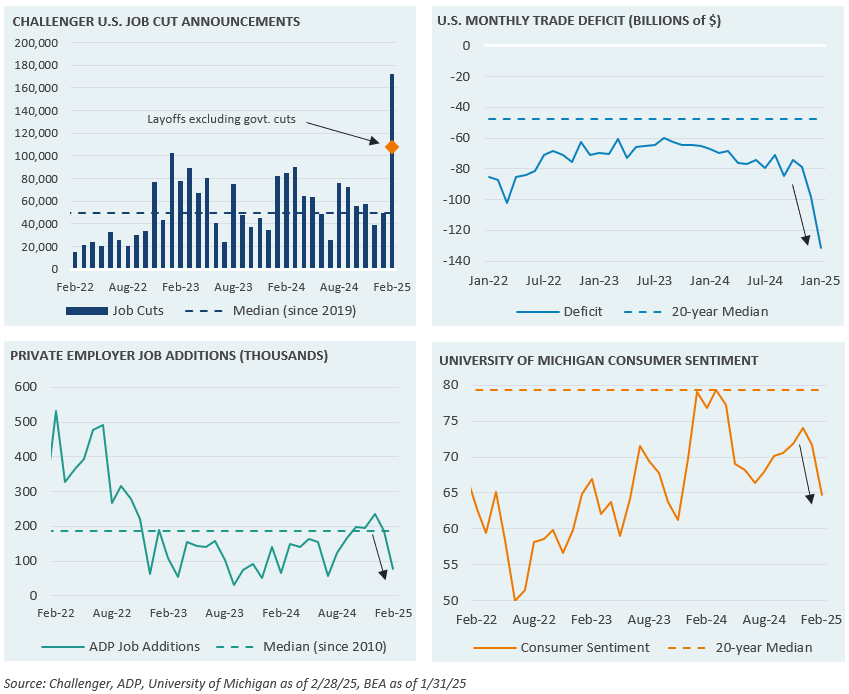

In recent weeks investors have witnessed weaker-than-expected economic data in a variety of places. This, along with tariff standoffs between the U.S. and our largest trading partners, has contributed to a drawdown in risk assets and lower bond yields. Fear of tariffs appear to be casting a shadow over consumer sentiment and may be changing business behavior due to uncertainty about future prices and conditions. Consumer expectations for inflation have also moved markedly higher.

This week’s Market Note illustrates some economic indicators that have recently suggested a slowdown. Regardless of whether an investor believes tariffs will ultimately be imposed on a sustained basis, the fear of tariffs alone could result in some economic weakness, creating a self-fulfilling prophecy where consumers and businesses spend more conservatively due to an uncertain future. We continue to see the economy and future prospects as strong but are watching conditions closely.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they do not constitute investment advice or a recommendation to buy, sell or hold a particular security or pursue a particular trading strategy.