Verus Sound Thinking: So What Now? (Download the PDF)

Since the change of U.S. political administration in January, we have had a huge amount of action and change – more than we and many other commentators expected. The change in tariff policy last week has shocked markets and led to a much higher possibility of recession in the near-term for the domestic economy and many other economies around the world. This short note is designed to help frame out how we are assessing this significant shift in policy, and to help investors think through the implications.

We begin with our conclusions:

- The changes to the tariff regime are significant and the implications for the economy could be large.

- It is reasonable for investors to be concerned about the economic impact these policy changes would have if everything announced this past week were to go into effect – that explains the substantial market reactions since the announcement.

- To balance this, however, it is clear to us that the announcement represents more the opening of aggressive negotiations, rather than a set in stone conclusion, and that the result of those negotiations could be improvements in bilateral terms of trade with some key trading partners (although further escalation with other trading partners is also likely). For example, as this memo is being written, the Wall Street Journal reports that 50 countries have reached out to the Trump administration and are in negotiations.

- In other words: it is completely justified to be concerned with this overall situation, but it is too early to know with clarity where this will end up or what the impact on the economy might be. As long as investors have well diversified portfolios, we believe it is too early to make big changes in response to this news.

The Background

President Trump has been consistent in his views about tariffs and trade policy for many years, at least since the mid-1980s. He has consistently expressed concerns about what he perceives as an imbalanced trade relationship not only with adversaries but also with friendly countries and has talked positively about tariffs as a way to redress this imbalance.

During his first term he advanced this agenda to some extent, most directly against China. Tariffs increased, a trade deal was agreed, but the promises made under that deal were not met (at least in part due to Covid). It seems unlikely this experience increased his confidence that promises made by trade counterparties, especially those regarded more as adversaries than as friends, were likely to be kept.

The Second Term: What Has Changed

Trump’s first term was difficult. Disagreement or obstruction from within the executive branch combined with opposition from Congress and a lack of familiarity with the levers of government and how to drive change led to less progress on many issues than he might have liked. The second term seems different. The Trump team appears to have spent the four years out of office planning, and in particular planning how to make sure the executive branch acted as implementer for the Chief Executive rather than as a source of obstruction: views on the resulting policies, of course, will depend on the reader’s political views. If the first term was marked by loud and aggressive messaging but less action than that messaging would suggest, what we have seen in the second term so far is both an increase in the assertiveness of the messaging and an increase in the level of action to actually implement the announced policies.

The Announcement

The plan announced this past week contains a number of key components:

- A standard level of tariffs at 10% which apply effectively across the board

- Higher tariffs in places where there is not “reciprocity”, although the calculation used to determine that reciprocity focused on trade deficits, not tariffs, and has come under significant criticism

- An exemption for goods covered by the USMCA (importantly negotiated by Trump in his first term)

- An explicit threat that retaliation would be retaliated against in kind

The announcement is expansive in scope and represents a wholesale restructuring of trade relationships across the globe rather than a targeted country-by-country approach. That is clearly an active choice, and while the administration may not have expected quite the scale of reaction from markets that investors have endured so far, it parallels other “shock and awe” announcements since the inauguration.

Market Reaction

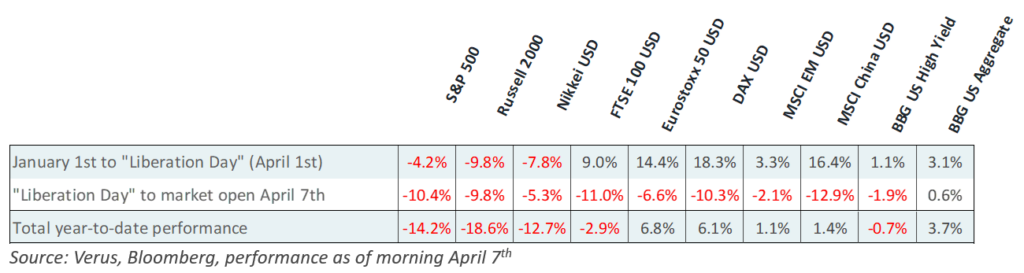

The response from markets can be seen in the following table. Investors sold risk assets and bought U.S. government bonds (4.57% U.S. 10-year Treasury yield to start the year, relative to 4.14% today), while credit spreads widened (287bps option-adjusted spread to start the year, relative to 427bps today). Expectations for Federal Reserve rate cuts in 2025 also jumped from less than 2 cuts expected to now 4 total cuts expected for the year. International equity and emerging market equity suffered along with U.S. equity, which means that many trading partners of the U.S. are also feeling pressure to relieve this stress in the near-term.

Market Concerns

The markets are concerned about tariffs for a variety of reasons:

- Inflation. Tariffs represent, all else being equal, a cost increase on things that are imported. Unless 100% of these costs are assumed by the company doing the importing, then they will increase prices: this creates inflationary pressures. It is apparent that the goal here is to cause a change in consumption patterns away from imported products and to domestic products. Tariffs are in fact a raw mechanism that can be used to drive that desired outcome, as the hope is that the purchaser chooses the domestic product rather than the now more expensive foreign product subject to tariffs. Also, there are many foreign products for which no domestically-made alternative exists and no domestically-made alternative is likely to exist in the foreseeable future. This means that in some circumstances, a domestic production benefit may not be seen and prices will go higher.

- Growth. Tariffs represent a frictional cost, and the uncertainty caused by them also provides a frictional disincentive to economic activity. This can cause a drain on GDP growth, although the exact effect and the timing of it can be hard to forecast.

- Slowing Trade. Tariffs are designed to increase domestic production while decreasing offshore production. This would act as a natural disincentive to trade.

- Unemployment. Companies facing higher costs and greater uncertainty may reconsider hiring decisions, and may consider reducing staff, potentially raising unemployment.

- Retaliatory slowdown. Retaliation, either through U.S. trading partners increasing tariffs or through consumers and businesses in foreign markets choosing to voluntarily reduce consumption of U.S. goods, will slow overall business.

- The “let’s wait and see” effect. This is perhaps one of the greater and most difficult to measure concerns. Many businesses that are threatened with the costs of tariffs will need to decide to either bear the higher tariff costs and raise prices (and/or suffer lower profits) or instead make a decision to onshore certain business activities inside U.S. borders. But the process of onshoring business activities could mean substantial investments in plant, equipment, and personnel that takes years to complete. Given the extreme uncertainty of what tariff rates will be in a few years, not to mention a few weeks or months, the most logical business decision may in fact be to wait and hold off on any business investment until there is more clarity on policy. If, all at once, many businesses around the country (and possibly around the world) halt investment and operational decisions, this could create a meaningful shock to the domestic and global economy.

There are also specific concerns about this particular announcement:

- Arbitrariness. The calculation approach of the new tariffs, which turns out was likely focused on the trade deficit between the country and the U.S. rather than actual international tariff rates (as was suggested by the administration), has come under significant criticism and has been attacked by many as being inaccurate or arbitrary. This perception of arbitrariness extends to the expectation that the end result of the process will be negotiated rates based on the best deal achievable with each country, rather than a more principled approach. The perceived arbitrariness of the announced tariff rates adds to confusion and likely frictional costs mentioned in the above thoughts.

- Suddenness. The rapidity of the process, from proposal to implementation, raises concerns with some that the implementation of the new tariffs will be challenging and that adjustments to economies, supply chains, and decision making will be hard to make in a similar timeframe.

- Scale. The scale of these tariffs, both in the fact that they are being applied across effectively all trading relationships and represent very significant increases in tariffs in many instances, has caused concern, as companies and countries affected by them will find it hard to adjust even were the flexibility there.

Additional/Offsetting Considerations

- Inflation or Price Shock. There is generally a distinction between a one-off price shift caused by a specific shock and real inflation, caused by excessive increase in money supply. These tariffs, even if they go into full effect, represent more of a one-off price shift, and would be unlikely to represent an on-going increase in the natural rate of inflation.

- Input Costs. In the time since the announcement, we have seen some commodities drop in price significantly, particularly oil, based on uncertainty and an expectation of slowing growth. This could provide an offset against some of the upward price pressure caused by tariffs, although it creates notable economic pain across American businesses that operate in these sectors.

- Interest Rates. The flow of money into government bonds has caused downward pressure on interest rates. Although the Federal Reserve has been clear they are taking a wait-and-see approach to short-term rates, the administration has been clear they are focused more on the interest rates on longer-term bonds, which have been dropping. The aim for lower interest rates reportedly ties into the administration’s goal of better managing / refinancing the country’s growing national debt load.

- Offsetting Growth. The intention of these tariffs is to drive more business activity within U.S. borders. Whether or not this is on balance successful is one question – but there will clearly be some movement by some companies to do this, and that will have a stimulative effect which will act as somewhat of a counter to the slowing element mentioned above. But there may be a timing mismatch here if pain is felt in the near-term and business onshoring benefits occur over a longer period of time.

Our Thinking

This situation is changing very quickly and the eventual outcomes are unclear.

There is a clear push from the administration towards a more onshore economy for the United States. The wording used around this topic focuses both on economics and, importantly, on defense and ensuring that the U.S. has control over the supply chain for vital defense and self-sustainability products. This implies that a simple economic-focused analysis to the path forward will miss important parts of the story.

As we have outlined above, there are a wide variety of legitimate economic concerns around a higher tariff environment, although it is highly likely that some trade partners will come to the table and offer more attractive trade terms to the U.S. We expect some ‘wins’ to be announced by the Trump administration in the coming weeks and months which could potentially provide somewhat of a calming effect to markets.

There will be real winners and losers from a structural shift towards less global supply chains. We do believe that this is a new environment, and that the probability of the Trump administration broadly reversing course is low. Companies and countries that have designed their entire model around a fully offshored model will find that model less effective and will probably be disadvantaged by it in the new environment. It seems likely that there will be strong lobbying and negotiation over these vulnerabilities: we will be watching closely to see the degree of flexibility offered by the administration.

We expect rapid negotiations resulting in some relaxations of these tariffs with many key trade partners, but material tariffs to stay in effect: as we said, we believe this is a new world.

The scale of the changes is much larger than the market expected, and that has increased legitimate fears of retaliation, recession (possibly globally) and a larger risk market sell-off. Market sell-offs since the announcement have been substantial and reflect those markets trying to price that additional risk. That does not, however, mean that all of the bad outcomes will in fact materialize: what will matter is the net effect after negotiations including both positive and negative outcomes. The short-term effects are also going to be unclear – for some goods there will likely be an uptick of sales as companies try to compete to gain market share or to take advantage of “pre-tariff inventory”. This could create a head-fake effect before bigger economic pain can be observed.

With all of this said, today we see a few broad outcomes below as main possibilities, and have assigned approximate probabilities to each:

- Base Case (60% likelihood): Announced tariffs have sparked serious negotiations with major U.S. trading partners, and many bilateral deals will be reached that reduce or perhaps even eliminate tariffs. Retaliatory tariffs will be selective and largely not permanent. Businesses take a cautious approach but do not halt investment entirely. The Federal Reserve remains watchful and data dependent. In this scenario, we see market volatility remaining high in the short-term but coming down later in the year. The U.S. avoids recession although growth slows. Signs of business onshoring is evident in areas such as semiconductors, defense-related goods, and critical supply chains. Investment portfolios benefit from diversification.

- Best Case Scenario (20% likelihood): Announced tariffs serve mainly as leverage and quick bilateral trade wins are secured by the U.S. administration. Most tariffs are walked back for cooperative trade partners. Global supply chains adjust with less disruption than expected. No major retaliatory tariffs appear to be permanent. U.S. inflation remains lower as falling commodity prices and stronger dollar offset tariff inflationary effects. Markets gain more confidence and understanding of the Trump administration policy stance. In this scenario, we see equity and risk markets rebounding later in 2025. Business investment accelerates, especially given onshoring activity and new infrastructure investments.

- Worst Case Scenario (20% likelihood): Most announced tariffs go fully into effect, with major trading partners broadly retaliating. Consumer prices jump and inflation moves higher. Supply chains struggle and product shortages occur. Businesses hold off on investments due to uncertainty which results in a drop in economic activity. The Federal Reserve keeps rates steady despite a weakening economy due to inflation concerns, which raises fears of a stagflationary environment. In this scenario, the U.S. enters recession in 2025, global growth falls sharply (emerging markets seeing the most pain), and equity markets fall further. Credit spreads jump. Policy uncertainty deepens and political pressure reaches extreme levels.

It is worth noting that market downturns of this scale are not unheard of when markets are digesting big changes. Over the last 50 years there have been 8 downturns of this size in the S&P 500, and in 75% of those instances the market has been up in the following 12 months (with an average S&P 500 12-month return of +32%). The two instances where the market was not up 12 months later after this size of drawdown were times when the market drop was followed by a U.S. recession (2001 Tech Bubble and 2007-2008 Global Financial Crisis). The average 12-month return following the initial drawdown was -17.9% on those two occasions. This highlights the importance of determining whether this will in fact push the U.S. economy into recession: while the probability of a mild recession has increased, we are not yet in a place where a material recession is our base case expectation.

Diversifying assets have done their job so far. Fixed income duration has been rewarded and has offset some of the equity market downturn. We believe retaining diversification in portfolios and allowing for rebalancing to take effect at the appropriate time is a sensible approach.

Over the next month we will all get a much clearer view of how this story is most likely to play out. The ability of counterparties to negotiate will become clearer and the focus of the administration will also be more evident. We are likely in a lower growth and higher inflation environment: what is not clear yet is whether that will tip the economy into recession. For now, we will watch for real data and provide ongoing thoughts through our regular Verus research publications, while being careful to avoid either excessive pessimism or excessive optimism.

Notes & Disclosures

Past performance is no guarantee of future results. This report or presentation is provided for informational purposes only and is directed to institutional clients and eligible institutional counterparties only and should not be relied upon by retail investors. Nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security or pursue a particular investment vehicle or any trading strategy. The opinions and information expressed are current as of the date provided or cited only and are subject to change without notice. This information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. This report or presentation cannot be used by the recipient for advertising or sales promotion purposes.

The material may include estimates, outlooks, projections and other “forward-looking statements.” Such statements can be identified by the use of terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” or the negative of any of the foregoing or comparable terminology, or by discussion of strategy, or assumptions such as economic conditions underlying other statements. No assurance can be given that future results described or implied by any forward looking information will be achieved. Actual events may differ significantly from those presented. Investing entails risks, including possible loss of principal. Risk controls and models do not promise any level of performance or guarantee against loss of principal.