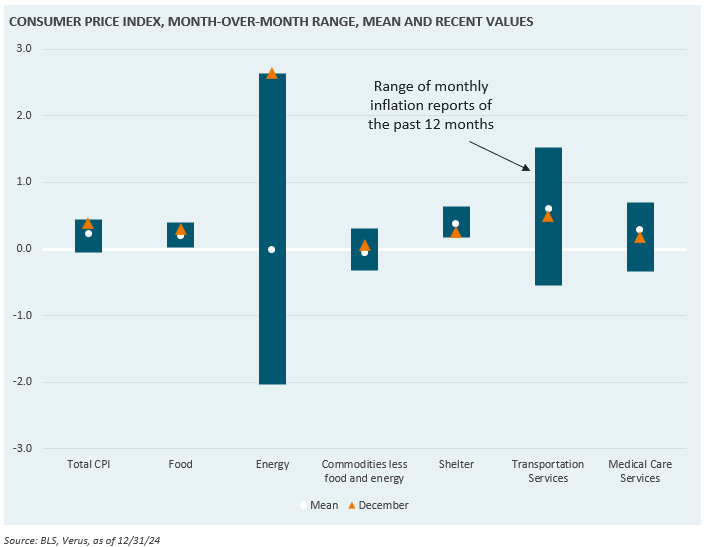

Yesterday’s inflation report was lower than expected, though still fairly hot overall. Month-over-month inflation in December was higher than most months of the past year, fueled primarily by a large jump in energy prices. Many other goods and services showed below-average price rises in December, including housing (shelter) costs which have lately been the largest support to inflation. Core inflation, which excludes food and energy prices, fell slightly to 3.2% year-over-year. Following the release of this news, markets now expect the next Fed rate cut to occur in June, instead of September.

This week’s Market Note examines monthly inflation across different categories of the official CPI calculation, comparing December’s report to the past twelve monthly reports.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.