Executive Summary

Effectively managing a portfolio involves gathering information, processing information, making decisions, and implementation. Much of an investor’s success depends on their ability to process information, although this tends to be a less discussed aspect of investing. There is certainly no drought of information in this industry – ranging from the daily news broadcasts of traditional media, to pundits confidently providing their take on market movements, to audacious market forecasts that are inevitably picked up in news headlines. For every investor, making sense of this stream of information is both very important, and also a bit complex. By the time that information reaches an investor, it has typically been interpreted by someone along the way. And because we are all human, those interpretations are impacted by a variety of things. For example, a market expert who is also the CIO of a major investment firm may be incentivized to interpret markets in a way that makes potential clients excited about the products offered by that CIO’s firm. A mainstream news reporter may, perhaps unwittingly, report the news in a way which aligns with the particular leanings of the reporter’s news agency (political or otherwise). Or, a market pundit making an audacious call that a certain investment is now set to rise dramatically or to crash in price may be incentivized to make that audacious call knowing that the wilder the call, the greater the airtime – incentivizing the pundit to make big and wild calls. These are all examples of biases that may make every investor’s job of processing information more difficult.

In this Topic of Interest paper, we offer a few perspectives regarding what we watch out for to acknowledge or even avoid biases where possible. During the research process, we believe it is just as important to determine what does not matter as it is to determine what matters – deciding what matters most to the portfolio by ensuring a balanced set of information sources, keeping a watchful eye for biases and carefully thinking about incentives, and also determining what doesn’t matter. Entertaining and exciting news is often not important and impactful to the portfolio.

Striving for a balanced set of news sources

The health of the economy tends to have a significant impact on market performance and cycles. This means that how an investor feels about the economy, and where they believe the economy is headed, will impact the investor’s tolerance for taking market risk through time. How an investor feels about the economy is typically influenced, at least to a degree, by the news media that the investor consumes and the way in which these news sources portray the economy. Unfortunately, perception of the economy is often influenced by political leanings, which has become especially acute in the current hyper-partisan environment. This can be illustrated below, using studies conducted by the University of Michigan1.

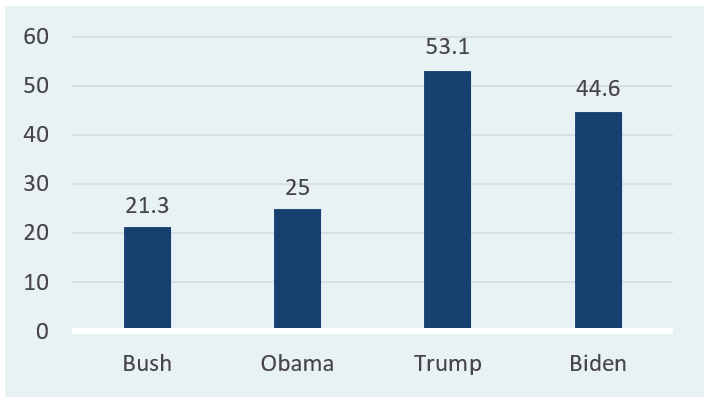

PARTISAN GAP FOR ECONOMIC EXPECTATIONS INDEX

Source: “Partisan Perceptions and Expectations”, University of Michigan. The “partisan gap” represents the difference in the University of Michigan Expectations Index for Democrats and Republicans under each administration. The Expectations Index measures how positively (or negatively) consumers view their own financial situation, and the economy in the near-term and long-term.

While some gap in economic perception has existed in each of the last several administrations, recently this gap has been much wider (political party affiliation has had a bigger impact on how an individual views the health of the U.S. economy). For example, in 2016, a dramatic improvement occurred in how Republicans viewed the strength of the economy at the onset of President Trump’s victory, while Democrats saw the economy as worsening. Following the 2020 election, Democratic perception of the economy improved as President Biden entered the White House, while Republican perception declined significantly. This effect has tended to hold throughout history, and matters to investors who consume traditional news media, as most media outlets exhibit at least a moderate leaning towards one political viewpoint. If an investor receives a somewhat biased view of the economy and economic conditions on an ongoing basis, this likely impacts the investor’s economic outlook and therefore their views on taking market risk.

To help mitigate this bias and to ensure more balanced news flow around the economy, investors might consider working to either consume media across both sides of the political spectrum or focus on centrist/neutral media sources. Plenty of research has been conducted on biases in media – one such example is a study from Ad Fontes2 which examined 3,600 news sources, 700 podcasts, and 474 TV programs. This study made an effort to chart each news source based on political leaning and also based on whether the source is believed to be more focused on facts or on persuasion. While we certainly do not endorse all of the exact classifications shown in this research, this sort of content may help investors to identify biases in their news sources and perhaps work to strike a better balance, if appropriate.

Please note that these thoughts are in no way meant to be a condemnation of traditional media or any individual media source – the authors of this paper both subscribe to a variety of traditional media sources and find great value in the coverage. Instead, our thoughts in this section are simply meant as a reminder that all media companies are led by people, and people have political beliefs and their own ways in which they view the world.

Investment experts & some caveats

In this industry, there is no shortfall of very intelligent people who appear to say very intelligent things about the markets. When listening to the investment experts, we believe it is very important to think about three things; Who are you listening to and what is their expertise? What are the reasons that they are providing this information? Is what they are saying relevant to your portfolio?

As an example, let’s think about a hypothetical situation: a well-known bond manager who has just delivered an intelligent set of bond market viewpoints on a popular investment news broadcast. Let’s apply our three questions we just mentioned:

- Who are you listening to and what is their expertise? This is a fixed income expert discussing fixed income markets (this should be reassuring).

- What other incentives might this professional have to make the market call? It turns out this fixed income professional’s firm coincidentally just launched a fund that would benefit from investors following their market advice (this should make us a bit skeptical of bias).

- Is what they are saying relevant to your portfolio? If this market pundit is discussing an esoteric corner of the bond market that your portfolio has no exposure to, it may be a better use of time moving to the next news topic of the day.

We would place special emphasis on question #2 above. In our experience, it is rare to see leadership of a private equity firm, for example, explaining that the environment is just not ideal for allocating to private equity, or to hear an active manager of a public equity fund explaining that passive management will likely outperform active management in the near future. Investment experts go on television and give opinions often with a business reason in mind. Investors should work to acknowledge what that business reason might be, and whether these views should be taken with a grain of salt.

Once again, we do not intend for these thoughts to be any sort of condemnation of investment funds or investment experts – these are intelligent people who create considerable value, and work incredibly hard, for their clients. Instead, this section is meant to offer a quick filter that investors might use to work through their daily news, and to be watchful for business interests and potential bias in the marketplace.

Doom & Gloom and Euphoria

As a continuation of the prior theme, we feel investors should be particularly watchful for doom & gloom forecasts, and also those of euphoria. As humans, our attention is naturally drawn to exciting things that are “against the grain” and “different”. This provides an incentive for investment experts to make wild forecasts through time, because those wild forecasts attract more eyeballs and draw attention to the expert’s firm. Attention is great for media companies, so these experts often make for regular guests on air. Unfortunately, wild forecasts that rarely come to fruition are not particularly helpful for everyday investment decision-making.

In our industry especially, negative forecasts tend to be even more attention-grabbing than positive ones. Many studies, including one from the Proceedings of the National Academy of Sciences, have supported the idea that the human brain has a stronger reaction to negative news than positive news3. Ongoing outrageous forecasts that draw clicks, and the human bias towards negativity, mean that it is very important for us as investors to look through the noise and to think hard and carefully about how events in the news materially (or immaterially) affect our own portfolio.

Once again, many examples exist of intelligent investors who have in fact foreseen a housing market collapse, an economic calamity, or the popping of a bubble. Our theme here is not to discount these fantastically prescient forecasts, but to point out that there are likely hundreds of forecasts for doom & gloom that turned out incorrect for every one correct forecast. Investors may be well served by keeping a skeptical eye when receiving news and opinion in this category, generally speaking.

Conclusion

Effectively managing a portfolio involves gathering information, processing information, making decisions, and implementation. Much of an investor’s success largely depends on their ability to process information. In this Topic of Interest paper, we offer a few perspectives regarding what we watch out for to acknowledge or even avoid biases where possible. During the research process, we believe it is just as important to determine what does not matter as it is to determine what matters – deciding what matters most to the portfolio by ensuring a balanced set of information sources, keeping a watchful eye for biases and carefully thinking about incentives, and also determining what doesn’t matter. Entertaining and exciting news is often not important and impactful to the portfolio.

For more information regarding our views on this topic, please reach out to your Verus consultants.

Notes & Disclosures

- Joanne Hsu, publication, Survey of Consumers: Partisan Perceptions and Expectations (Ann Arbor, Michigan, 2024). ↩︎

- ad fontes media. Accessed January 14, 2025. https://app.adfontesmedia.com/chart/interactive. ↩︎

- Stuart Soroka, Patrick Fournier, and Lilach Nir, “Cross-National Evidence of a Negativity Bias in Psychophysiological Reactions to News,” Proceedings of the National Academy of Sciences of the United States of America, September 3, 2019, https://www.pnas.org/doi/full/10.1073/pnas.1908369116#sec-3. ↩︎

Past performance is no guarantee of future results. This report or presentation is provided for informational purposes only and is directed to institutional clients and eligible institutional counterparties only and should not be relied upon by retail investors. Nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security or pursue a particular investment vehicle or any trading strategy. The opinions and information expressed are current as of the date provided or cited only and are subject to change without notice. This information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. This report or presentation cannot be used by the recipient for advertising or sales promotion purposes.

The material may include estimates, outlooks, projections and other “forward-looking statements.” Such statements can be identified by the use of terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” or the negative of any of the foregoing or comparable terminology, or by discussion of strategy, or assumptions such as economic conditions underlying other statements. No assurance can be given that future results described or implied by any forward looking information will be achieved. Actual events may differ significantly from those presented. Investing entails risks, including possible loss of principal. Risk controls and models do not promise any level of performance or guarantee against loss of principal.