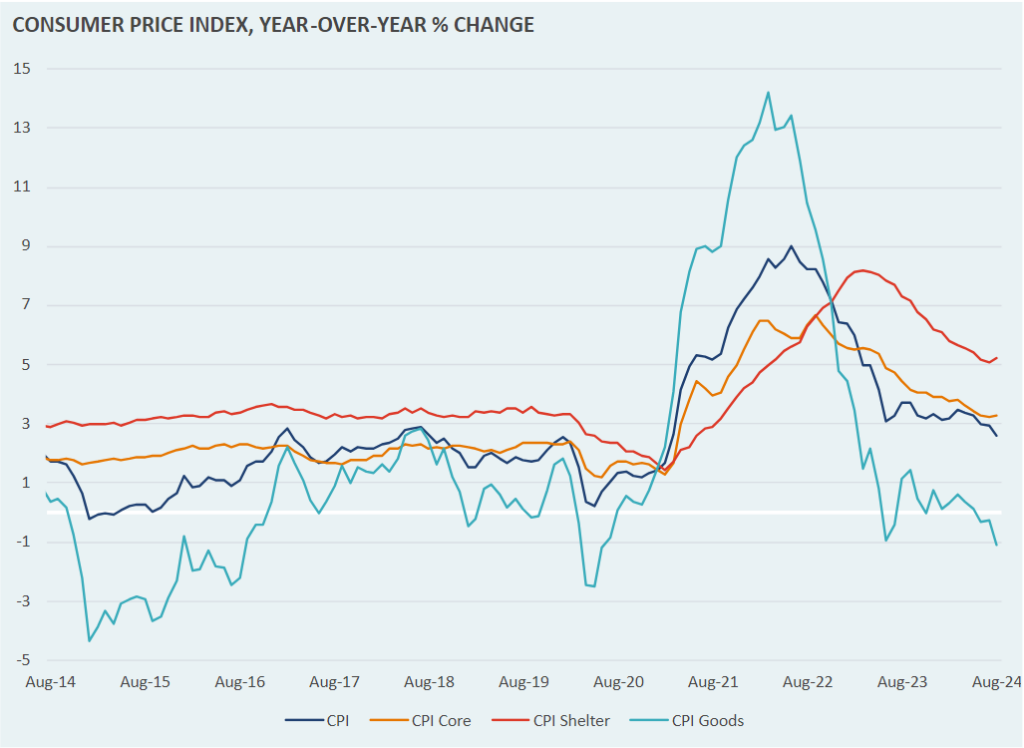

In recent years, shelter has been a major factor in supporting high inflation. While the rate of increase of shelter prices has slowed in 2024, August showed a larger-than-expected uptick in shelter costs.

Despite headline inflation falling to 2.5%, Core CPI year-over-year, which excludes food and energy prices, increased to 3.2%. This disappointed markets, and odds for a 50bps September rate cut eased.

The inflation story has become split in terms of services inflation and goods inflation. Services inflation has remained high, fueled primarily by housing costs. Meanwhile, goods prices have been falling. New and used vehicle prices have dropped, along with household goods such as appliances, furniture, and hardware. Lower energy prices have had perhaps the largest deflationary effect.

In this week’s Market Note, we highlight a few inflation categories to illustrate the price trends of goods vs. services.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.