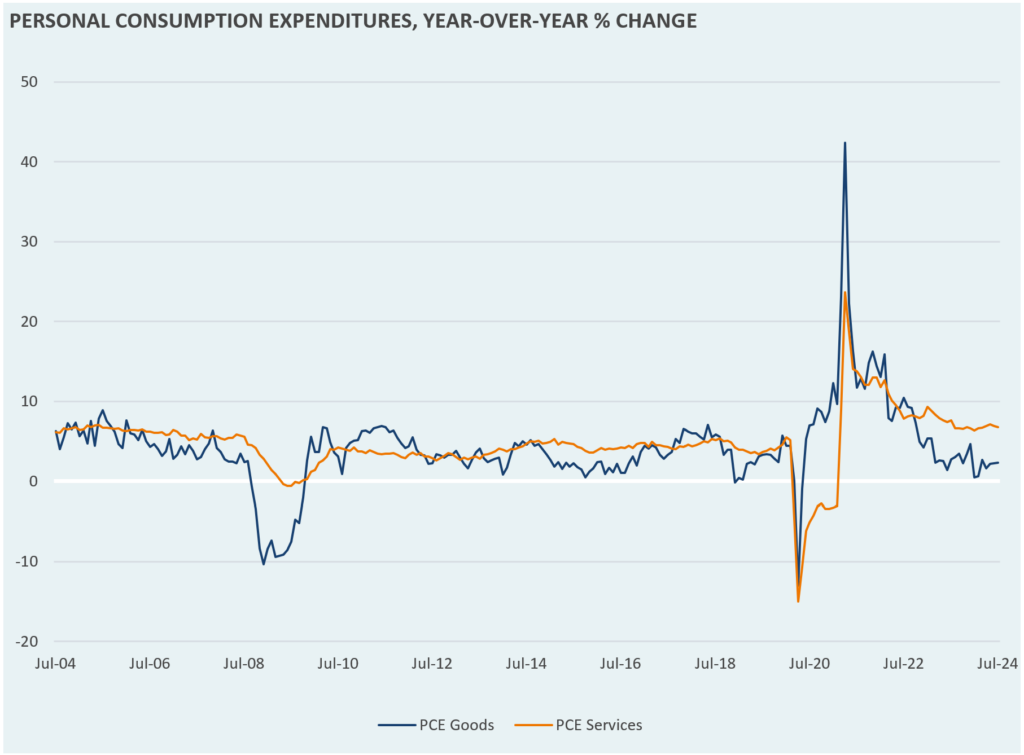

In recent years, consumer purchases of goods have significantly lagged the purchases of services. This effect often occurs during rising interest rate environments, due to big-ticket items such as autos and homes, as well as other physical goods, being more difficult to afford when financing rates are higher. During the same period, U.S. manufacturing activity has shown continued weakness, as reflected in Tuesday’s ISM Manufacturing PMI report. These two trends are likely linked at least partially, as more than half of U.S. manufacturing is consumer-facing, and most consumer-facing products are sold domestically rather than exported.

In this week’s Market Note, we outline the significant swing towards services and away from goods spending in the higher rate environment.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.