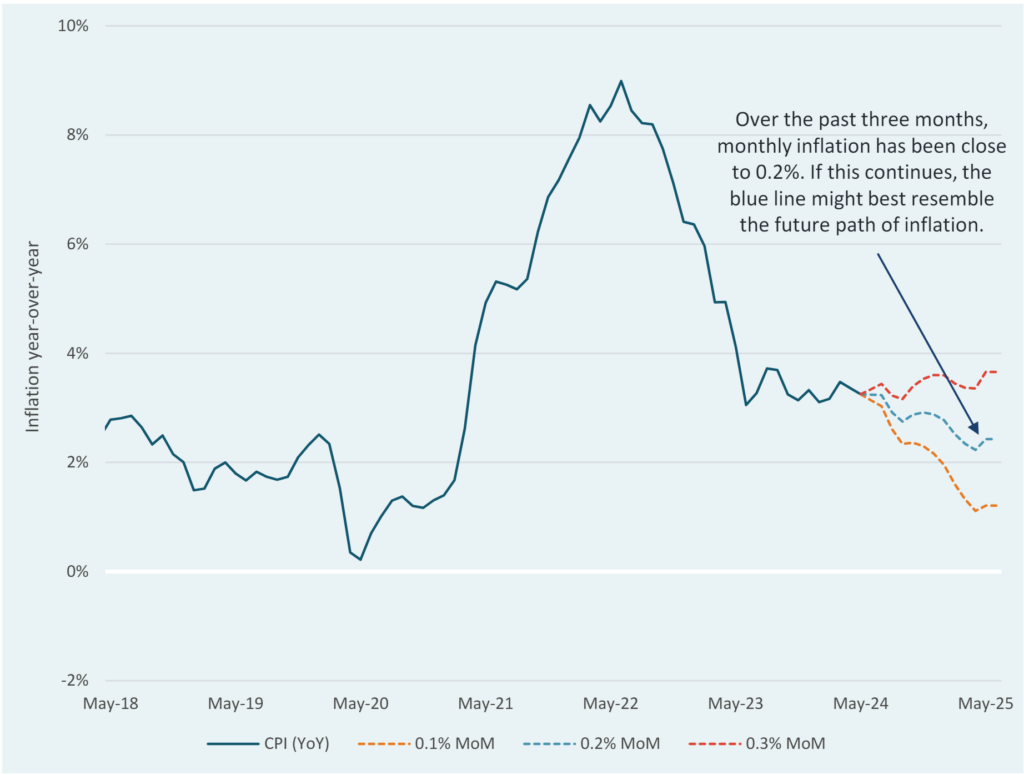

As the markets eagerly await the commencement of rate cuts from the Federal Reserve, cooling inflation is likely the primary factor that would guide the Fed towards looser monetary policy. The markets have been watching monthly inflation prints very closely, as the Fed has stated that they want to see inflation move “sustainably towards 2%” for them to begin cutting rates. In May, inflation came in flat on a month-over-month basis (0.0%), with CPI at +3.3% year-over year. Although PCE is the preferred inflation gauge for the Fed, we use CPI here as this tends to be the most followed inflation metric.

An understanding of how monthly inflation figures impact year-over-year inflation allows us to calculate the path of inflation using different monthly inflation assumptions. For example, if inflation were to come in at 0.2% each month in the future (near the recent three-month average), inflation would be near 2% in Spring of 2025. This week’s Market Note provides a visual representation of a few possible inflation paths.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.