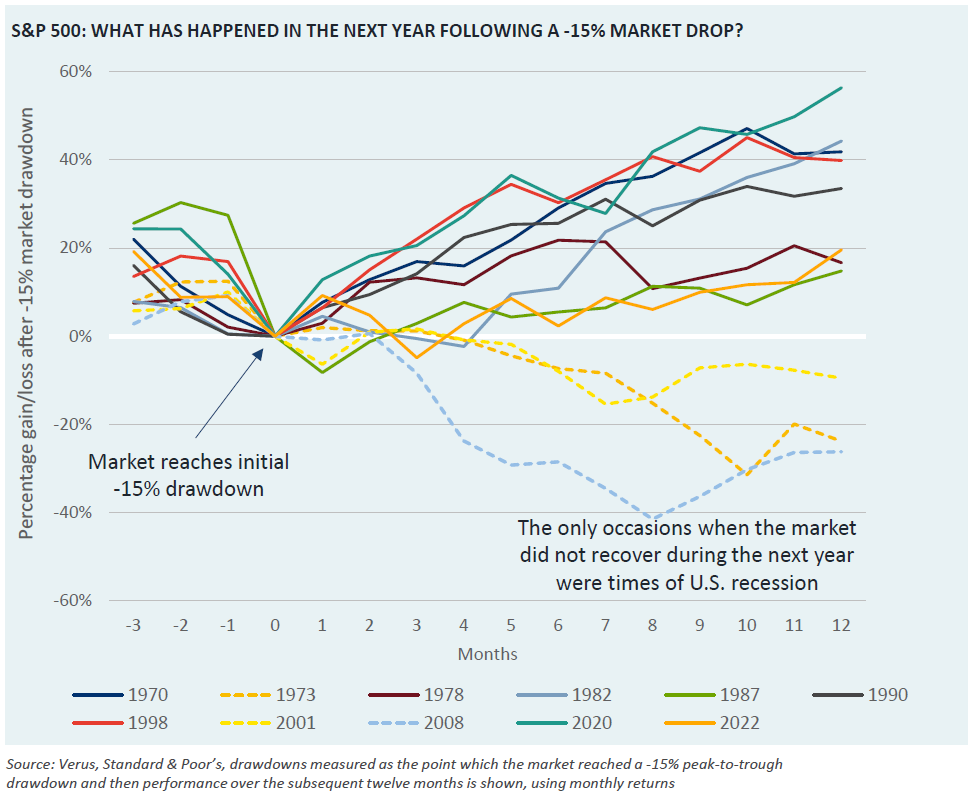

The S&P 500 has just experienced a -15% drawdown. Has this historically been a good time to invest?

Market downturns of this scale are not unheard of when markets are digesting big changes. In this week’s Market Note, we illustrate market drawdowns of similar size since 1970. The average S&P 500 return in the following 12 months after the drawdown was +19%. The three instances where the market was not up 12 months later were times when the market drop was followed by a U.S. recession (1973-1975 Economic Stagnation, 2001 Tech Bubble, and 2007-2008 Global Financial Crisis). The average 12-month return following the initial drawdown was -19% on those occasions. This highlights the importance of determining whether tariff negotiations will in fact push the U.S. economy into recession.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they do not constitute investment advice or a recommendation to buy, sell or hold a particular security or pursue a particular trading strategy.