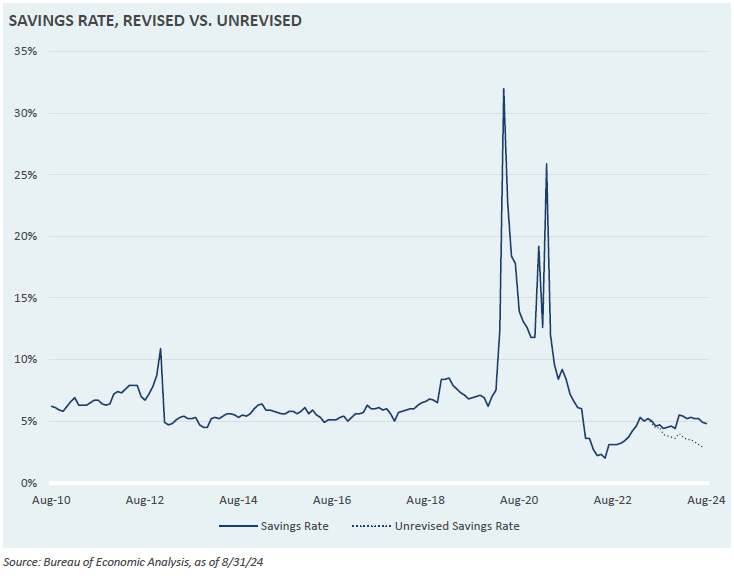

Throughout most of the year, personal income data released by the Bureau of Economic Analysis had shown that the proportion of income consumers were saving was falling to historical depressed levels. This led to fears that inflation was hurting consumers, to the point that perhaps they were changing their savings habits to make ends meet or even taking on credit card debt. More recently, data revisions from the reporting agency suggest that consumers are in a better place than previously believed. While there is no doubt that inflation has had a significant detrimental effect on household finances, it appears savings rates are closer to normal levels.

This week’s Market Note looks at the revised savings rate, compared to the previous unrevised data. A higher savings rate means a greater likelihood that Americans continue spending at a robust pace. Markets will be watching intently to see if this spending carries over into corporate earnings announcements in the coming weeks.

The Verus Market Note provides market commentary along with relevant charts and graphs. Each week, we highlight a key story from the finance world that we believe will pique your interest. While these insights are meant to inform and enrich your understanding of the current market landscape, they should not be taken as direct recommendations for immediate portfolio adjustments.